Buying Gold From The Royal Mint Could Change

Synopsis

With gold hitting a record spot price and predictions that this will only increase, bullish investors are seeing renewed interest in the precious metal as a safe haven for retaining wealth. But, as we see the decline of cash usage the world over, the producers of this popular investment choice will have to adapt to the modern market; something that may not be as good as it seems.

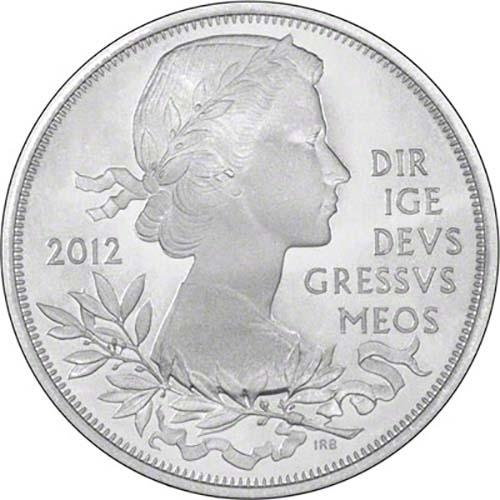

Commemorative Coin Collections from The Royal Mint

Saying in the year ahead they will concentrate their efforts on “collectable coins”, the Royal Mint’s new marketing approach will lend legitimacy to the marketing tactics we have previously addressed as (and widely reported to be by watchdogs) misleading, making the average consumer believe they are making a long term investment that will only appreciate in value, with the reality being more akin to “investing” in novelty, niche collectors' items such as rare comic books or vinyl records.

Looking Past The Surface

These collectable coins will only be worth more to those who believe they are, that appreciate the craftsmanship and aesthetics behind each piece. But, to an actual gold dealer who will look at the value of the gold contents of the coin (the only thing that actually maintains any worth in the coin beyond a subjective assignment of wealth) these “must have items” pushed by the Mint will be seen as no more special than the denomination the designs are stamped on, seeing the extra money spent on these “one off” or “commemorative” designs by the consumer be completely lost. We are not trying to condemn the manufacturing of coins that have an artistic flare, showcase a new design or a release that commemorates an event of historical significance; but when these are created with the intent of cashing in on those new to investing whilst justifying the sale using the same reasoning as legitimate investment pieces, it cannot go unchallenged.

Marketing To Watch Out For

We see these practices often from a small number of bullion dealers, but what does surprise us is seeing these methods employed from an industry leader, and authoritative voice in the numismatic industry like the Royal Mint. It's understandable to see why the Mint would choose to pursue this ethically risqué line of marketing. In August 2019 The Times of London reported that the Mint had seen a 40% increase on the previous year in customers wanting to invest in precious metals, and with the price of gold enjoying a 6-year high, it would be all too easy to dupe this new wave of investors into buying overpriced novelty coins.

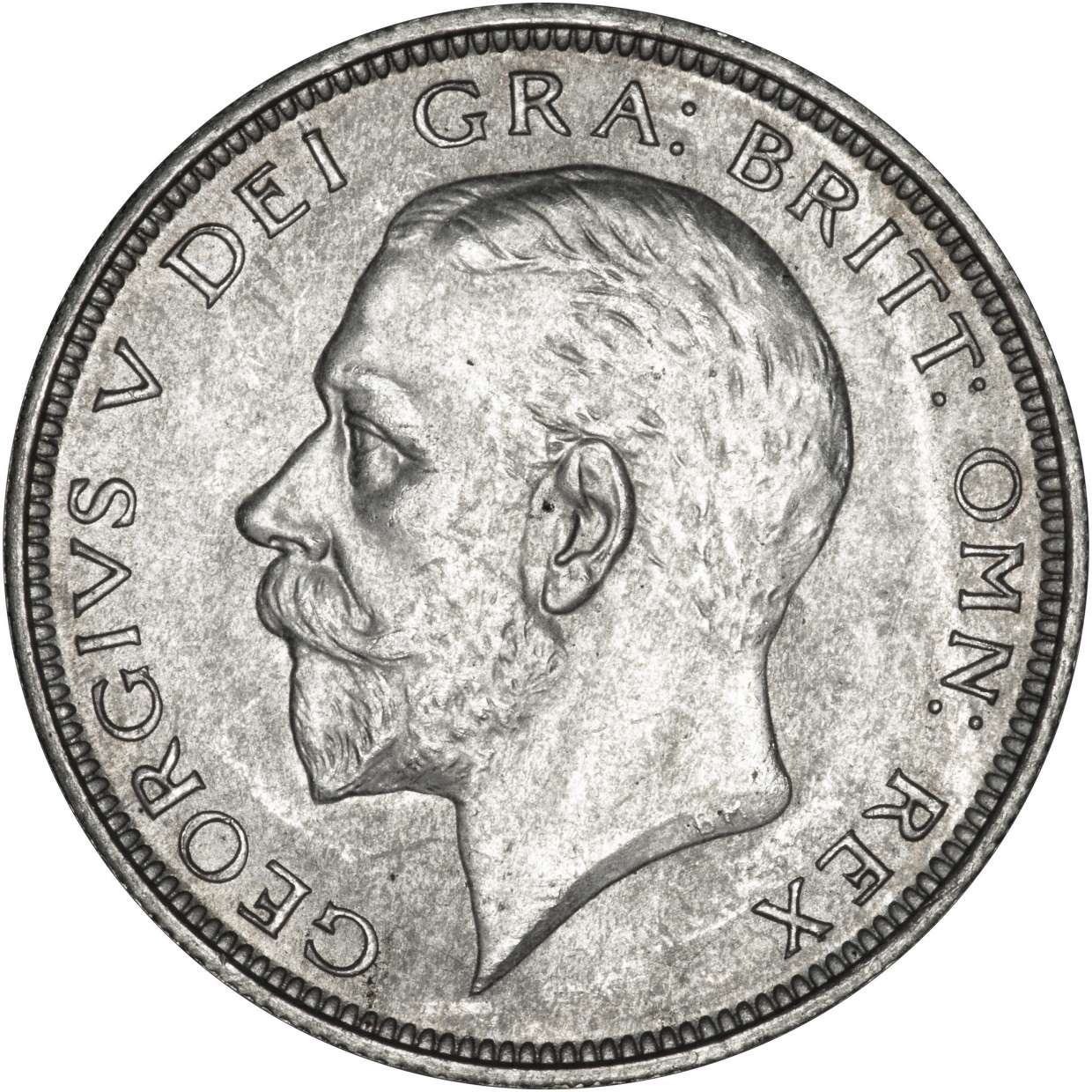

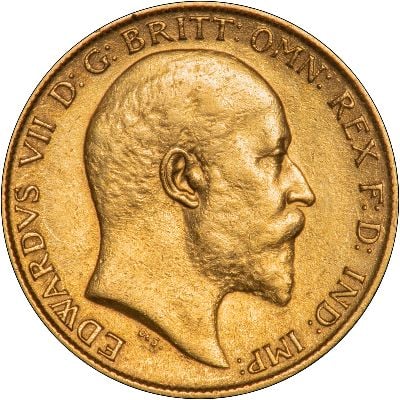

The 2019 Sovereign

The additional cost the Royal Mint place on their coins hasn’t gone unnoticed, with their 2019 sovereign being marketed at almost double the retail value of bullion sovereigns, justified by the coins “limited availability”, walnut veneer case and certificate of authenticity, all of which do nothing to increase the actual value of the coin’s gold content. What is important to remember is that whilst The Royal Mint is seen as an authoritative figure in the numismatic world, they are still operating as a business. Whilst the “spot price” or the market price for gold is the coin’s actual value, the additional premium placed on top of this cost is how the Mint, dealers and other bullion business’s keep their doors open. Unlike other coinage retailers and precious metal dealers, The Royal Mint is in a fortunate position to leverage over 1000 years of history to uphold their monopoly and “authority” over the market and of this they are very much aware. This hasn’t evaded the attention of less honest dealerships either, with many trying to impersonate The Royal Mint in an effort to capitalise on their heritage, more commonly seen through imitation correspondence adorned with coats of arms and regal imagery.

Will Cash Always Be King?

However, this favourable position doesn’t make the Mint immune to market trends and socio-economic changes. The growth of a predominantly cashless society, meaning that perhaps over the coming decades, unless the self-proclaimed tour de force of international coin production adapts, they will see their main source of revenue become redundant and lost with the times, with their products perhaps becoming more akin to novelty items.

Checking Your Change

In their 2018-19 annual report The Royal Mint’s Chief Executive, Anne Jessopp, detailed that their demographic of coin collectors has grown from 180,000 to 238,000 over the last year alone; take this into account alongside a statement from the Mint’s chairman saying the declining use of physical cash has “resulted in more competitive tenders for overseas coins and less demand for UK coin”, and it’s not hard to see how The Royal Mint now plans to earn its weight in gold. The increasing prominence of a cashless society has been leaving mints scrambling for a solution, finding additional sources of revenue that have previously been left on the periphery of the business. This change in how the public choose to spend is forcing the major banks to change their practice, with this being passed on to the Mint through a lower demand for newly produced coinage. Showing a 16% fall on the previous year, 2018 saw 26% of transactions be fulfilled with cash and 15.1 billion transactions being completed using a debit card. This decline in physical money is expected to continue with UK Finance forecasting that by 2028 cash will be used in only 9% of all UK transactions.

Research Your Investment

But, for those in search of a safe haven asset, bullion coins are still the gold standard, with clued up investors and collectors finding themselves rarely swindled. Whilst the approach to salesmanship may be changing, the cues for a sound investment remain, buying at an opportune time, reflected by a low spot price and premium.

A Clear Choice?

As always, our intent is to educate and inform the investment and collecting communities, and we bring this to your attention due to the already high prevalence of mimicry from dealers imitating the Mint. If The Royal Mint were to start regularly selling similar items, the lines making legitimate trading clear will be further blurred.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.