China: Commercial Banks and Retail Gold

Synopsis

The World Gold Council (WGC) recently took a look at the physical gold market in China. Their outlook sees opportunities for commercial banks to benefit from the bullish momentum of the gold price.

Recent Trends

Growth in sales of physical gold from commercial banks have softened over recent years, and last year dropped to around 70 tonnes from around 95 tonnes in 2018. Growth in other channels have been much more positive apart from the most recent drop from approximately 215 tonnes in 2018 to around 145 tonnes in 2019.

Despite recent trends, a look at gold sales through the Shanghai Gold Exchange (SGE), see much larger growth over the last decade, but again with declining sales through 2019. Growth in “paper gold” also show positive growth and haven’t experienced any decline.

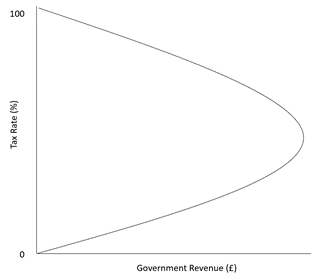

As is fairly common, a strong stock market tends to drive investment away from gold as can be seen in the 51% stock market surge in 2014 and the 2019 rise of 36%

Increased Competition

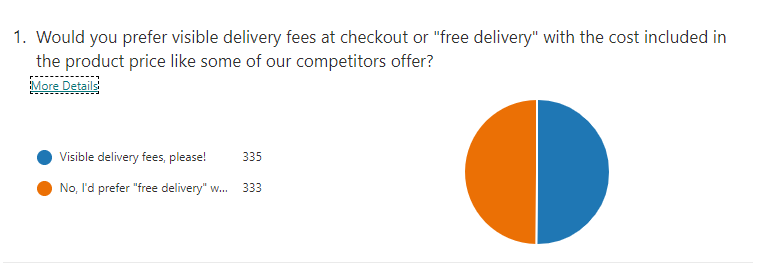

Commercial banks are still the preferred choice for those wishing to buy gold coins and bars although increasing competition has developed among jewellery retailers.

Some of the factors driving competition are the discounts that retailers are able to offer, which are not possible for commercial banks due to the complex systems and layers of approval needed to support transactions. Retailers are also likely to give a heavier focus to marketing, which is not available to banks due to the increased regulations.

ETF Growth

The introduction of gold Exchange-Traded Funds (ETFs), in 2013 quickly gained interest and have been growing at an average of 208% ever since. Much of this growth has been down to the simplicity of purchase, the low thresholds, which are offered in low units as 0.005 grams, and the option to deliver the physical product.

ETFs are also available to trade on online apps such as WeChat and Ali-pay which are two of the most commonly used apps in China. This is a major factor to the decline of gold accumulation plans (GAPs) which began in 2010 but lost popularity in later years. GAPs are still only available through the banks themselves or online banking apps.

Opportunities and Outlook

Gold still features heavily in portfolios, and research shows that gold bars are the third most popular investment asset, behind savings accounts and life insurance. Popularity for gold, in fact has risen compared to similar research conducted in 2016.

The risk-averse nature of Chinese investors means there is still a huge potential for future growth. Younger investors even more so

The 2020 economic environment offers opportunities for the commercial banks to improve and grow their gold trades. The combination of lagging economies, threats of inflation and low interest rates plus the increasing awareness of the need for wealth preservation, give banks the ideal chance to tap into the market that they are currently missing out on.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.