Silver: Still Unappreciated?

Synopsis

With prices seemingly stuck in the proverbial mud, a look at the last 6 months shows a silver lining for an often-overshadowed asset.

2020: A Year to Forget?

It’s been a rollercoaster, undoubtedly. Bushfires, a global pandemic, economic lockdowns, bankruptcies, riots and protests, record-breaking asset prices, all within the first 6 months. As we head into the final quarter, we’re stuck in another quasi-lockdown, another round of the on-going Brexit debacle, and head into a US election which seems to be the most dismal election since the last one!

A Silver Lining?

Looking back over the last 6 months, we’ve seen record prices with gold but since then, it has taken a turn, despite expectations. All metals appear to be in the doldrums with expectations of a vaccine or increased stimulus packages hampering any serious movement.

We took a look at how prices have fared over the last 6 months, and while there has been improvement across the board, they’ve shown that the oft-forgotten silver metal has performed better than its metal counterparts and the stock market.

| Asset | Price on 08th April (£) | Price on 08th October (£) | Price Change |

| Gold | 1,336.23 | 1,461.67 | 9.39% |

| Silver | 12.14 | 18.72 | 54.2% |

| Platinum | 598.00 | 673.95 | 12.7% |

| Palladium | 1,757.00 | 1,840.80 | 4.77% |

| FTSE-100 | 5,842.70 | 5,987.07 | 2.47% |

Silver vs. The World

Silver, like gold, is still seen as a traditional safe haven asset and has kept its role alongside gold as a store of wealth. The uses of silver outweigh that of gold which is primarily used in the jewellery market. The Covid pandemic has helped to elevate demand for precious metals, but with an increasing global focus on “green” technology solutions, demand has only increased further due to the use of silver in solar panels and electric vehicles. According to Spectator magazine, from 2018 to 2019, silver demand grew from 988.3 million ounces to 991.8 million ounces. If the green tech sector continues and people turn to solar power and electric cars, then silver will undoubtedly retain its investment status, particularly as other metals are either too scarce, too expensive, or just inadequate.

Potential

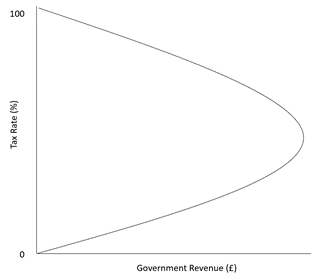

When comparing prices of silver against other metals, it's easy to dismiss silver as a cheap or even poor alternative. After all, a price of £18.72, compared with a price of £1461.67, the most expensive would appear to be the most valuable. However, considering a larger picture, the greater volatility of an asset can have incredible returns for those with the right risk appetite.

It’s unlikely that silver prices will exceed gold’s but it’s industrial usage may see sharp rises over time and so will still play a role in any portfolio.

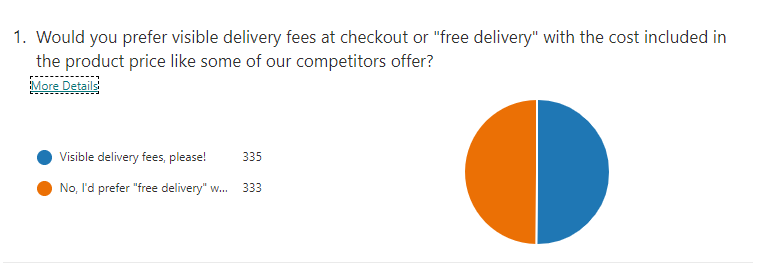

You can see live and historic metals prices by clicking the image below.

You may be interested in our Industry for Silver blog.

Click the link to see our silver products.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.