Is it Time to End VAT on Investment Silver?

Synopsis

One of the benefits of being a member of the European Union is the access to reduced or even zero-rated silver. This ended for the UK on 1st January 2021.

Estonia, the only country to offer VAT-free (zero-rated) silver has had a competitive advantage over its EU counterparts, due to a legal loophole meant to restrict the flow of international exports.

Now that Estonia’s VAT-free silver law is due to end on the 1st of July 2022, the rest of the EU will look to countries with reduced rates on silver like Switzerland (8%) or Norway (0% on silver coins).

Is it time for the UK to become more competitive and reduce or even scrap VAT on silver?

Most investors will likely respond in the positive, but is it that simple?

(This article focuses on silver, but the argument should also be applied for platinum group metals as well.)

VAT in the UK

VAT is often claimed to be superior to a straight-forward sales tax, as it creates tax revenue throughout the production process, whereas a sales tax only creates revenue at the end of the process. This is perhaps why most major economies, with the exception of the US charge VAT.

The introduction of a value-added tax came as a condition of the UK’s membership into the European Economic Community (EEC). VAT on goods was implemented on 2nd April 1973 replacing the previous Purchase Tax which began during World War II as a way of limiting wastage on raw materials. Its introductory rate of 10%, was quickly reduced to 8% with a 12.5% rate on certain luxury goods and petrol. These two rates were eventually unified at 15% before being increased to 17.5% in 1991 and then 20% in 2011 where it has stayed since.

Investment Gold

The rationale behind "Investment Gold" being VAT-exempt in the EU was that it is unfair to tax investments at their outset, as this would be a strong disincentive to invest, and that in most of Europe, private holding of gold has long been considered as a traditional method of investment. This was often in the form of gold coins.

Until WW1, most currencies and coinage systems were based on a gold standard, or a silver standard. This afforded some protection for private individuals to protect themselves from devaluation and unchecked inflation, and therefore from some of the excesses of incompetent or corrupt politicians and governments. It also seems unfair to levy consumer taxes of coins, banknotes, and other forms of money.

This provides a double argument for silver coins to be exempt from VAT.

VAT on Silver

The additional 20% cost on silver and Platinum Group Metals (PGMs) leaves investors with a quandary. Silver’s low price (relative to gold) is certainly something many investors would want to take advantage of. Its historic store of value, industrial usage and volatility can give favourable returns which can often beat gold over certain periods.

However, these gains are much harder to realise when the additional cost is ultimately borne by the consumer. Gold, on the other hand, which given its own definition of “investment gold” as per HMRC Notice 702/21, is VAT free and in the case of many Royal Mint-issued UK coins is also exempt from capital gains tax (CGT).

There are also arguments for silver bullion bars, and for precious metal coins and bullion bars to be exempt from consumer taxes on acquisition.

That being said, there are options for investors to avoid such excessive taxes, but even these can come at a financial or economic cost.

Special Scheme

Secondary market or “pre-owned” silver has the benefit of falling under the VAT margin scheme or “special scheme”. This scheme means the only VAT charged is on the dealer’s profit margin.

For example, using an intrinsic silver price of £16.96 per troy oz., a new 1 oz silver Britannia coin may have a premium of £4.30 per coin, with an additional 20% VAT totalling £25.51 per coin.

A second-hand coin bought at the same intrinsic price and sold at the same premium would cost only £22.12 as the VAT would be paid on 20% of the margin (4.3 x 0.2 = £0.86).

Even to the novice investor, a saving of £3.39 per oz. of silver is no small saving.

With silver demand already high, the supply of secondary market silver has decreased while demand has only grown. This has led to secondary market products being increasingly more difficult to source.

Furthermore, worldwide government restrictions across most sectors have choked supply chains and halted production of new silver leading to shortages, most noticeably in computer chips. This has had a knock-on effect in areas such as computing and the automotive industries who rely heavily on raw materials for new products.

The special scheme itself, while giving investors a cheaper alternative, has shown to be an inadequate solution in light of ongoing supply issues.

Bonded Warehousing

Storing silver and PGMs in bonded warehouses in the UK or overseas comes with several benefits, not least of all, the avoidance of VAT. This type of storage reduces risk of loss or theft as these bonded warehouses are not only secure but fully insured. This does come at a cost with companies charging varying rates for storage. Storing overseas also gives investors peace of mind with some pointing to US Executive Order 6102 and the Exchange Control Act of 1947 as examples of gold confiscation, or more correctly appropriation, by governments. This is why many choose to store their gold in more "neutral" locations such as Switzerland or Singapore.

There are, however, several downsides to storing in bonded locations. Firstly, arranging physical delivery or collection of stored items is particularly troublesome, and even when all relevant checks are completed, VAT will still be due on said items when they arrive in their destination country.

Many advocates of physical silver may argue “if you can’t hold it, you don’t own it”. While there is some merit to this argument, a logical conclusion would be to store ALL your physical silver (and gold) at a place where your investment is easily accessible to you (and others presumably!). Those with high volumes of precious metals will certainly see some benefit of keeping their wealth far away from the hands of criminals, political or otherwise!

Estonia and Tax-Free Silver

The EU sets the VAT rules for its member states, although how these rules are applied is decided at the national level. This is why rates vary from country to country and why many states purchase silver elsewhere in the Union.

Based on a mandated minimum rate of 15%, rates for VAT range from 17% in Luxembourg to 27% in Hungary. Reduced rates at a minimum of 5% are also charged with Hungary again charging the highest reduced rate of 18%.

According to COUNCIL DIRECTIVE 2006/112/EC,

‘…where the customer of the services supplied by the intermediary is identified for VAT purposes in a Member State other than that within the territory of which that transaction is carried out, the place of the supply of services by the intermediary shall be deemed to be within the territory of the Member State which issued the customer with the VAT identification number under which the service was rendered to him.’

In Estonia, silver bars are liable for VAT at the standard rate, whereas silver coins are zero-rated. Therefore, EU investors (and UK investors up until January 2021), could purchase silver from an Estonian dealer and either provide a courier or collect themselves, thus avoiding any VAT as the transaction has been completed in Estonia.

According to Global VAT Compliance:

The Estonian Government has ruled that VAT should not be charged on the importation of goods made by EU sellers to cushion the impact of COVID-19. However, the VAT exemption does not include goods which are imported for the purpose of resale. (Emphasis added)

This amendment will come into force on 1st July 2022 and will end the possibility of purchasing VAT-free silver anywhere in the EU. This could create an opportunity for the UK to create a competitive advantage by overhauling VAT on precious metals.

Brexit, Covid, Inflation etc.

There are a number of reasons why the UK (and the rest of the world, for that matter) is in such dire straits. Brexiteers are unhappy because although we have left the EU, we really (kind of) haven’t; the Remainers are unhappy because although we (kind of) haven’t left the EU, we really have!

The worldwide lockdowns destroyed production everywhere and left many people out of work, despondent, and reliant on government furlough payments and stimulus checks. The unfathomable amount of money spent by governments “supporting” the very economies that they themselves shut down has led to skyrocketing national debts (congratulations to the US on recently reaching the incredible milestone of a £30 trillion).

Now, as inflation continues to exceed central bank targets, and some estimating inflation to reach double digits, it would be fair and sensible to allow the public access to precious metal investment with as little cost as possible in order to protect their ever-dwindling savings.

Will VAT-Reforms Make the UK More Competitive?

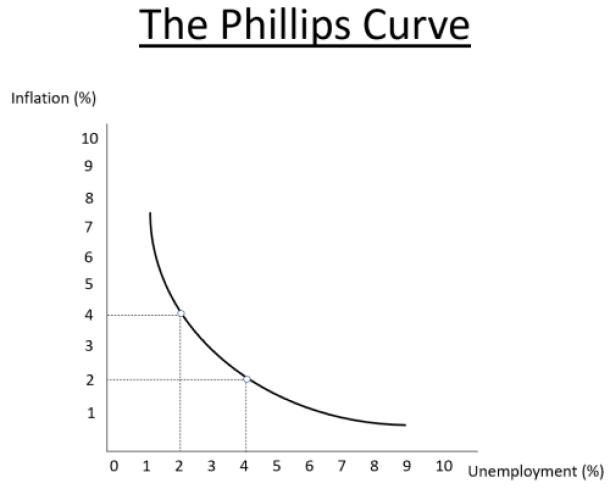

The Laffer Curve

In the 1970s, economist Arthur Laffer sketched how high increased taxation didn’t always lead to increased revenues. Arguing that as tax rates increase, more people try and avoid tax, for example either by working less (and paying less income tax), or perhaps more relevant, purchasing tax-exempt gold rather than taxable silver (and avoiding VAT).

The theory is simple and actually dates as far back as the 14th century. It was however most commonly linked with Laffer and has since been called the Laffer Curve.

The standard rate for VAT in the UK is 20% and applies to most goods and services. It also has a reduced rate of 5% for other goods such as home energy and children’s car seats, a zero rate for most food, children’s clothes and some finance instruments, and of course VAT-exempt items such as investment gold.

There are also arguments for silver bullion bars, and for precious metal coins to be exempt from consumer taxes on acquisition.

If the Laffer Curve is correct, and a 20% tax is too high, then perhaps the government should reduce the rate of tax, allowing investors who otherwise wouldn’t have bought silver, exposure to the investment asset and possibly even increase revenue. Unfortunately, VAT receipts are reported per industry, not individual item so it would be difficult, if not impossible at ascertain how much revenue is generated from an individual product, especially ones with so many industrial uses.

Or, give all precious metals the same treatment as investment gold, and create an “investment silver”, “investment platinum” etc. exemption putting these investment metals on an equal footing. This could mean that customers would have to undergo similar Know-Your-Customer (KYC) checks as listed under section 7 of VAT Notice 701/21.

Both options could offer possible benefits to the economy: increased productivity, reducing costs while simultaneously increasing tax revenue, removing bureaucratic tax accounting, but more importantly allowing more people to protect their wealth from the damage of inflation.

Conclusion

Tax is always a drawback when factoring in costs. The regressive nature of consumption taxes like sales taxes or value-added taxes means that they do more harm to the poor. Inflation being what it is (7.5% in the US at time of writing), low-income individuals need more opportunities to protect their savings from depreciation. This applies to anyone whether they are in the UK, EU or anywhere.

It is conceivable that closing the door on tax-free silver on the continent may not have the desired effect EU governments would like and instead just drive investment elsewhere.

The UK Treasury would lose very little by implementing these reforms, and would recoup much on eventual profits, in addition to correcting unfair practices which have long penalised and deterred many small investors.

Serious reforms take time, and even if it was to happen, it doesn't mean that the UK suddenly becomes the "Singapore-on-Thames" it was envisaged for when it left the EU. Although a reform would be a step in the right direction, the removal of VAT on silver here and on the continent would be more beneficial for both businesses and consumers.

Related Articles

Related Products

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.