Gold ETFs or Physical Gold Bullion?

Synopsis

If you are reading this page you are likely wondering about the difference between physical gold ownership and gold exchange-traded funds (ETFs).

An ETF is an investment fund operating on the stock exchange holding assets such as stocks, bonds or commodity.

As a bullion dealer and advocate of physical gold ownership, we would always buy gold coins or gold bars instead of ETFs. Being able to access and use your gold without involving a third party is, for us, immensely beneficial. Third parties often demand fees to use their services sometimes charging for depositing currency into accounts, transaction fees and even withdrawal fees. These eat away into any profit you make, or worse cause you to lose money if price increases don't cover the fees.

Gold ETF Shares

An exchange-traded fund is a security that can be bought and sold on a stock exchange and investments are used to invest in 99.5% purity gold bullion. When you buy an ETF, you are not buying gold but instead purchasing shares of the fund.

Many brokering systems operate online so you can deal from the comfort of your armchair without having to visit a dealer. You don't have to worry about storing your precious metals and remove the risk of theft or intrusion on your property.

Just remember, if you're worried about storage, you can let Chards take care of your gold as we offer storage in our state-of-the-art strong rooms.

ETF Pros and Cons

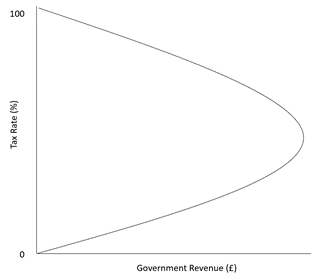

A benefit of ETFs is that they are priced in fractions of a ounce which means that those with a lower budget can access a gold investment without having to splash out on a 1 ounce coin or similar. For example, GLD (a ticker symbol for SPDR Gold Shares ETF on the NYSE), value a share at the price of 1/10 an ounce of gold. Often physical 1/10oz gold bullion coins come with a hefty premium. This means they aren't an ideal investment option relative to 1-ounce coins. With ETF's you can circumvent this premium, but you may end up paying more fees depending on the fund/platform you trade with.

One big drawback of ETFs is that you never actually own the gold which you have "bought" as you have bought shares in a fund, so essentially own a debt. The shares do track the live gold price, as each are backed by physical gold, so will fluctuate accordingly, but you are trusting that the fund itself is healthy and will not become insolvent. If it does fold you have to hope their insurance pay-out covers your original investment value at least.

The smaller initial costs for ETFs have certainly opened the market for a full range of private investors. The industry is worth trillions of dollars, but it is unlikely all investments are fully backed by physical gold. So, in the end if a company goes into liquidation your investment may be at risk. Physical gold is the ultimate safe haven from inflation and geo-political turmoil. So, if your aim is to protect yourself against this, it seems illogical to choose an ETF over physical gold.

Physical Gold

Without a doubt physical gold ownership is our preferred modus operandi. The fact that you can hold your gold in your hands for us is true ownership. There is no need to consult third parties or pay any fees to access or use your gold.

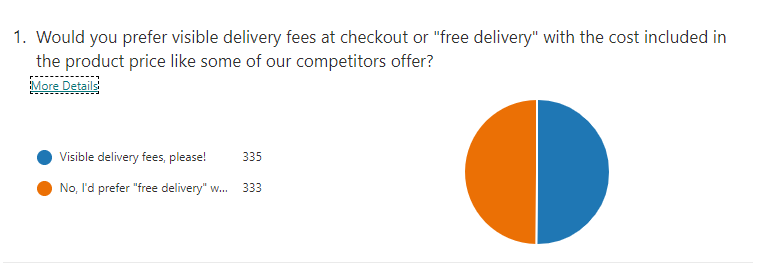

Transparent Pricing

Buying physical gold from Chards is made very easy as we publish all of our premiums. This way you can see exactly what percentage above gold spot price you are paying for your products. This can’t be said for some of our competition who hide this percentage away making it quite difficult to compare different weight products. Many wrap up postage in the overall cost and push this as "free postage", when it should more accurately be called "postage included". Read our page on why free postage might be cheating you out of the best deal. Not only this, but you can also view our buy back prices and with these two pieces of information you have your spread between buy and sell. Simple!

On the other hand, gold ETF's are dealt predominantly online and for the privilege of using the services you are charged fees. These fees will change for each provider and possibly even change based on your transaction volume or value. Charges can apply for depositing cash, transacting and even for withdrawal of money. It is essential to read the small print and understand where these "hidden" fees are, so you don't get stung and lose out.

If you would like physical gold but are worried about storage and security, why not let us take care of it and store it on your behalf? Rest assured customer’s gold always remains their possession. Never do we add a customers’ gold to our balance sheet, and you can access it at a moments notice, should you need to withdraw part or all of your investment. Not only this, but we offer preferential buy back rates up to 100% maximum on stored gold.

Take a closer look the benefits of physical gold ownership if you think this could be a good option for you.

Conclusion

Firstly, owning either ETFs or physical gold is already better than holding all your money in the bank! For us physical gold ownership is the better option in terms of eliminating the need for a third party, reducing risk and it is likely to offer you the better deals (see some of our best gold deals below). If storage and security of physical gold poses a problem or is encouraging you to buy ETFs then our state-of-the-art strong rooms are your answer.

If you're operating on a smaller budget, ETFs are good to get your foot in the door and benefit from gold price. The accessibility of trading online, should you live on the Outer Hebrides, may also be an advantage. However, if you are within driving distance of a bullion dealer, we highly encourage you to visit them to buy physical gold rather than ETFs.

If you do end up buying ETFs, please watch out for the fees, and do your homework on the platform and fund you invest in! Remember, you are buying shares from a company run by people who can become corrupt and fail you. Sure people make a lot of money in ETFs, but if you are looking to preserve wealth and distance yourself from the economy and financial institutions go with physical gold.

Physical Gold Bullion For Sale

The easiest way to compare the prices of coins is to look at the premiums on our products.

1 oz Gold Bullion Coin Best Value - Secondary MarketIn Stock

|

1 oz Krugerrand Gold Coin Best Value - Secondary MarketIn Stock |

Best Value Britannia 1 oz Gold Coin - Pre-OwnedOut Of Stock

|

1 oz Gold Coin Perth Mint Lunar Bullion Best Value - Secondary MarketOut Of Stock |

1 oz Gold Coin Maple Bullion Best Value - Secondary MarketIn Stock

|

1 oz Gold Bullion Coin Best Value - MintyIn Stock |

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.

.png)