Investing in Gold

Synopsis

This is our introduction article to investing in gold and throughout the guide we go into much more detail on various aspects including products, live prices, tax implications and try to sum up how you can get the best possible deal.

Our general advice is to buy at the lowest premium within reason. If you are looking to buy gold coins or bars at the lowest premiums, click here.

Investing in Gold

Investing in gold can be a minefield. Whether you are a seasoned investor, or are just thinking of investing in gold, there are questions that you should be asking. Is it a good investment? What should I buy?

If you already know these answers and are looking to buy the cheapest gold, view our lowest premium gold coins and bars and place your order now. To view our current offers on investment gold bullion, please click here. If not, read on!

Why Invest in Physical Gold?

Like with every investment there are pros and cons, but gold is not like other assets. One thing to note with investment gold is that it is a long term investment. It does not move in line with other assets.

Why Gold?

Gold is a good insurance against inflation and a great protection from an unstable economy. Do you remember the Great Recession in the 2000's? The effect of the 2007-2008 financial crisis resulting from the subprime mortgage market in America led to a credit crunch with some affected banks and investment firms closing as a result. The unemployment rate also rose.

So, what did gold do? During the period of 2008-2011, gold more than doubled its price per troy ounce. On March 2008, gold fixed at over $1,000 per ounce for the first time. In August 2011, we saw gold exceed the £1,000 mark and on the 5th September 2011 gold recording its highest ever fixes; £1,178.92, $1,896.50, €1,345.59. Meaning, if you bought an ounce of gold in 2007 and sold in 2011, you would have made approximately £800 per ounce.

Although gold can be volatile, investing in physical gold is a safe assurance that you have a physical commodity to sell back when the time is right. Also, unlike other forms of investment you get something that is aesthetically pleasing.

What is Bullion?

We would define bullion as simply, gold or silver bought and sold based on the value of its metal content (intrinsic value).

Bullion Coins For Sale

At Chards, bullion can be bought and sold as both coins and bars. We would always recommend investing in bullion rather than more expensive numismatic pieces for a pure gold investment. Collectable pieces can sell for tens if not hundreds of thousands of pounds, but you can be scammed and it’s easy to lose money. Obviously, if you are an experienced numismatist, this does not apply but if you are simply trying to invest in as much gold as possible go for bullion. So, which gold bullion should you buy?

Our most popular bullion coins are British Sovereigns, Gold Britannias and Krugerrands.

Krugerrands

Krugerrands are probably the most well-known bullion coin. First minted in South Africa in 1967, this coin was originally made to sell at low premiums over gold, so the coin itself is not one of the prettier coin designs. These coins are bought and sold readily from the secondary market, which enables them to be sold at low premiums.

Gold Britannias

Britain's answer to a 1oz bullion coin, produced in 198743, the Britannia is an attractive coin. The Britannias do not always portray the same design each year making it interesting to collectors as well as investors. The popularity of the Britannia has increased over the past few years, possibly due to the attraction of its Capital Gains Tax Exempt status.

Gold Sovereigns

The Sovereign tends to be a 'go-to' coin for investors wishing to have the option to liquidate their investment more easily. These British gold coins are smaller and are a more historic form of investment, so they tend to carry a slightly higher premium than the 1oz bullion coins. However, they are also exempt from Capital Gains Tax which is important to residents in the UK.

Gold Bullion 1oz Coins

Most countries issue their own bullion coins and we most likely have them all in stock. These will vary in premiums depending on supply and demand for each coin. Other coins which may be of interest are the American Eagle, Chinese Panda, Austrian Philharmonic, Australian Kangaroo Nuggets (another one of our favorites), and the Canadian Maple. These are just a small selection of the most popular bullion coins, you can view a wider range of gold coins in a variety of sizes here.

Gold Bars

Gold bars are often seen as a good investment. They do carry low premiums over gold and generally the bigger the bar, the smaller the premium. However, buy back prices are not as attractive on bars as they are on gold coins and you may be limited as to who will buy them back. You can view all of our 1kg gold bars on our dedicated page by clicking here.

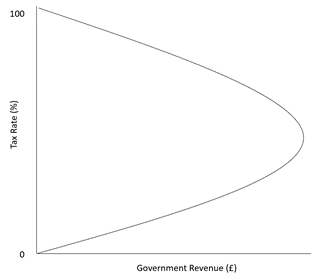

Gold Premiums - What Is A Premium?

A premium is the percentage charged over the intrinsic value of gold.

E.g. the gold price is £1000 per troy ounce. A one ounce coin is currently selling at £1030. This means the premium over gold is 3% (1030/1000=1.03).

We have made our prices easy for you, as all our final prices include the premium. We even go one step further and display our premiums on our pages. Why? So you can compare.

We would always advise you to shop around prior to purchasing. As stated previously, the price of gold can be volatile. The easiest way to compare prices is to compare premiums - not the final price of a particular coin - because by the time you get a price from another bullion dealer, gold will more than likely have fluctuated, thus not giving you a true representation of what the cheaper option is, as we would always say buy the cheapest gold coin!

You will see that we also have quantity breaks on some products, this means the more you buy, the cheaper the coin.

Why not view our YouTube video too:

Do I Pay Tax on Investment Gold?

VAT Notice 201/21A informs us that as of 1st January 2000, there is no value added tax payable on investment gold.

Do I Pay Capital Gains Tax on Gold?

Profits on the sale of investment gold is normally subject to Capital Gains Tax, except where investment gold has a legal tender status in pounds sterling, for example Britannias and Sovereigns. Although Sovereigns and Britannias are an attractive investment due to this, you may find lower premiums on coins such as Krugerrands and never be subject to Capital Gains Tax due to the profits made in one tax year. Read our blog Capital Gains Tax on Bullion – Do I pay this?

When Should I Buy Gold?

The obvious answer is, when it's low. Normally, when the gold price goes up people buy in the hope it will continue to rise. Alternatively, when the gold price drops, people tend to sell to beat gold dropping any lower. Don’t follow the trend. Wait until gold has bottomed out and then buy.

Even better, sign up to our mailing list. When we reach a surplus amount of stock we often reduce our premiums.

How Do I Buy Investment Gold?

Now you understand what bullion is, how to compare bullion using premiums and the right time to buy, the next step is to purchase.

All our prices are based on the live price of gold, so when you see a price that is right, you can place an order online or phone us to fix the price. Once a price is fixed, payment is payable immediately by bank transfer or debit card. Once your payment has cleared, your items will be dispatched within 48 hours (as long as they are in stock). You can even collect from our showroom - just make sure that you bring identity documents. It's that simple.

How Do I Sell My Investment Gold?

It's just as easy to sell your gold with us as it is to buy. Just phone or visit us and we will quote a buying price. If you are happy, you can fix the price and send your items to us the same day. We can make payment by bank transfer or cheque.

Related Blog Articles

Popular Products

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2025. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.