Gold as an Investment

Synopsis

For centuries, gold was always considered money. Since the adoption of fiat currency, the decline in gold’s circulation has been replaced by exchanging pieces of paper and even more recently, the mere push of a button and an alteration of digital bank accounts which now signifies a monetary transaction.

Gold as a Medium of Exchange

For a commodity to be considered as money, it must have an exchange value. Put simply, it would not only have value for direct use, but it must be able to be exchanged for goods of greater use.

Anthropological and archeological studies have shown that civilizations used gold and often silver to define prices for other goods. This was due to their durability, rarity and consistency so that each merchant or consumer knew how much they would be able to trade from one day to the next.

Over the years, certificates or “claims” became more convenient than carrying gold coins, so banknotes were issued that could be redeemed in quantities of gold on demand. Countries defined their currencies in weights of gold: the US dollar was defined as 1/20 an ounce of gold, the pound sterling was defined as ¼ an ounce. So, a $5 bill or a £1 would be exchanged with the bank for 5/20ths or ¼ of an ounce of gold. This became known as a gold standard.

Over time, thanks to government meddling and central bank shenanigans, the supply of banknotes increased much more rapidly than that of gold leading to financial crises and a devaluation of the currency.

Gresham’s Law argues that “bad money drives out good money”, which explains why people preferred to spend their banknotes and preserve their gold by taking it out of circulation.

In August 1971, President Nixon ended the still gold-redeemable dollar, forever ending any connection to a gold standard (which had been more of a pseudo-gold standard since the 1920s), leading to a purely fiat money system.

Gold as an Investment Asset

The difficulty in producing gold means that its supply is relatively consistent compared to paper currencies which can be printed at will by the central banks. This makes it a great asset to protect against rising price of goods as the purchasing power of fiat currency is reduced.

So, although gold is not used in day-to-day transactions, savvy investors often hold a fair proportion of the commodity in their portfolios to hedge against inflationary risks.

Investment gold can take a number of forms, such as coins, bars, “paper” and even digital. Much of this comes down to personal preference, but all have their own benefits.

Types of Investment Gold

Coins

Sovereigns, Britannias, Krugerrands, and Maples are just SOME of the coins available at Chard’s for investment or collecting purposes. Sovereigns were a common means of exchange from the mid-19th to early 20th century and had a face value of £1, although they contain slightly less that ¼ troy ounce of gold. The other coins, however are considered “modern” bullion coins and contain 1 troy oz of gold or fractions thereof.

For UK residents, we tend to recommend sovereigns or britannias, due to the fact that as they are denominated pounds sterling, and are considered UK legal tender, they have the added benefit of being exempt from Capital Gains Tax (CGT).

We do however offer coins from a number of different countries, so if UK coins are not what you are looking for, maybe an American Gold Eagle or an Austrian Philharmonic may be more suitable.

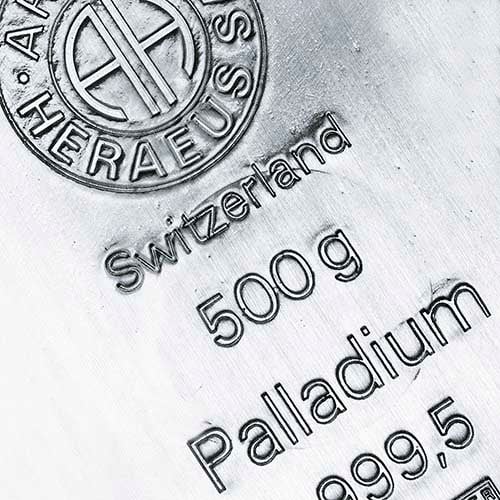

Bars

Like coins, bars come in a number of weights and are just as easy to store. There are some drawbacks such as not having the benefit of being CGT-exempt, but if you hold large bars, you would have to sell the whole bar rather than sell fractions of the bar.

When choosing physical gold coins or bars, you have the added choice of taking physical delivery or having it “allocated” and stored in our own state-of-the-art strong rooms or in vaults overseas.

ETFs or “Paper Gold”

We prefer to offer physical gold, but if you are not looking to take delivery of the physical product, an exchange-traded fund (ETF), maybe more beneficial.

An ETF is where funds are pooled in order to purchase large, 400 oz bars of gold. Rather than owning the gold outright, the gold is ”unallocated” so an investor only holds shares in the fund. ETFs are traded on stock exchanges so do not require the investor to pay extra for storage. Also, ETFs are traded in fractions of an ounce so even those on a budget are able to purchase shares in the fund.

Obviously, the main drawback is that you never actually own any gold. This means that there is a counterparty risk if the fund becomes insolvent, you may have to rely on its insurance to recoup the money you have invested.

Digital

Recently, we set up our DigitAul platform to purchase digital amounts of silver or gold. This was set up to allow our customers to put funds into an account before purchasing a physical coin or bar. The benefit of this is that paying in smaller amounts regularly, a fluctuating price means you are able to reduce the average cost of your purchase.

While we do not recommend using this for long term holdings, these can be effective as a short-term “savings account”.

Summary

As we’ve said we prefer to offer physical gold or safely vaulted “allocated gold” either in our own strong room or in our vaults overseas. Unallocated gold does have its own benefits but it does come with its own risks. We have a lot of articles relating to the different asset types. Click the links below to learn more.

Further Reading

Digital gold and digital silver

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.