We're Saying No To Buying Gold and Silver Bullion By Credit Card

Synopsis

As from 1 January 2018, Chard will not accept payment by credit card. We apologise to our customers who prefer this method of payment but unfortunately we feel like we have no choice.

We're Saying No To Bullion By Credit Card

Due to an EU directive which came into force on 13 January 2018, companies are banned from charging any fees or surcharges on credit card payments. This is partly to make credit card payments more competitive as currently some EU member states are allowed to apply surcharges to transactions and some member states are not. This directive aims to make it a 'level playing field', whether you are paying by cash, debit or credit card or bank transfer.

Directives are legally binding and must be incorporated into national law by EU countries. Each directive contains a deadline by which member countries must incorporate its provisions into their national legislation and inform the EU Commission to that effect. In this case, the EU directive was published in 2015, and the UK implemented it in 2018.

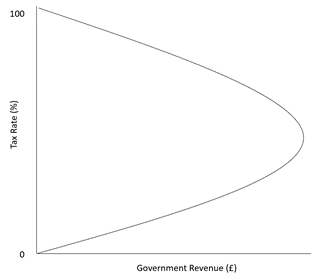

The government states that 'shoppers across the country have that bit of extra cash to spend on the things that matter to them', but don't be fooled. If you think this will save you money you will be wrong. It makes us furious when politicians and governments lie to the electorate. Most retailers will increase their prices willy-nilly to compensate for the loss of surcharges and you will end up paying extra for everything! The real rip-off is that consumers will end up being charged more across the board.

Credit Card Hidden Charges

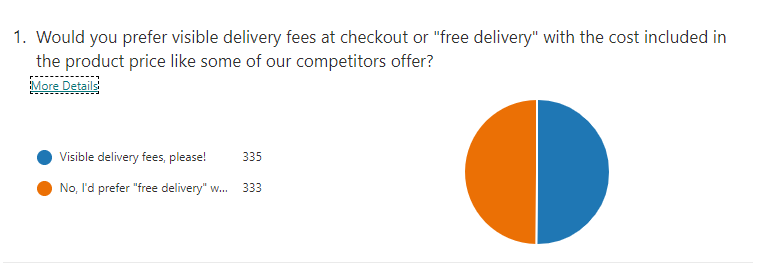

The old adage 'There's no such thing as a free lunch' is true. Commissions, fees, surcharges and free delivery are all hidden when they are built into product prices. Customers want to know exactly what they are paying for, so our charges are visible throughout. We were never keen on accepting credit card payments and had limited purchases to £500 for the following reasons:

- Credit card companies charge a commission to process payments. This can range from 2% to 5%. This is ultimately paid by the consumer. You may think that you are not paying this but that will be because many companies increase the product price in advance making it more expensive. So, customers paying by debit card, cash or bank transfer will be paying the same as those paying by credit card. Do you want to pay a higher price for your product so that someone else can have the privilege of paying by credit card? No, we didn't think so, and why should you? That is why we prefer to be transparent and have always shown the commission that you pay if you choose to pay by credit card. Then, it is the customer's choice whether to use the credit method or not.

- Whilst it may be convenient to pay for small purchases by credit card, the commission on larger sales can make the purchase considerably higher. If you are buying bullion, you are usually looking to pay the lowest premiums over the spot price. An extra 2-5% would make investment gold or silver more expensive which would affect the return on your asset.

- Depending on the size of the transaction, our gross profit margins generally vary less than 1% to 3% on investment gold and other bullion. To increase prices to absorb credit card commissions would stop us from being able to offer the great prices that we do at the moment. We do not want to increase the prices of our products to cover the relatively small percentage of purchases that are paid by credit card.

- Credit card fraud in the UK rocketed to over £618 million over the last year (2016-17). Credit card details are fairly easy to steal and as we sell commodities with a high resale value, this makes them a prime target for fraudsters, which is why we limited purchases to £500. You would need to buy a large number of books from Amazon to reach £500, but it won't even buy you a half ounce Krugerrand from us.

- We also do not accept payment by phone. It can be frustrating for our customers but ultimately we believe that this is an added protective security layer. CNP (Customer Not Present) transactions are more open to fraud. If the cardholder has been a victim of fraud, they can reject the transaction up to 12-18 months after the original purchase. If you are a victim of credit card fraud you will get your money back, however, it generally takes a considerable time before you are repaid and it can affect your credit scoring.

- Due to the nature of our business, we experience attempted fraudulent transactions almost every day. We adhere strictly to money laundering regulations and in-house policing takes time and resources. This includes carrying out customer due diligence measures. We don't mean to pry, but we need to check that you are who you say you are or we can be fined. This works the other way too. Many of our customers like to speak to us on the phone or come and visit our showroom to see exactly who we are, what we do and make sure that we are a 'real' company who will not disappear overnight.

Post-Brexit Update

The UK copied over all legacy EU-derived legislation when we left the European Union, therefore the above still stands.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.