2016 UK Coin 50p BU 950th Anniversary of the Battle of Hastings

The 2016 fifty pence commemorates the 950th Anniversary of the Battle of Hastings. Struck to a brilliant uncirculated finish, this 50p is British legal tender and comes in a presentation folder.

Save £2 when you buy from Chard!

More Info

Terms & Delivery

When King Edward of England (Edward the Confessor) died in 1066, he left no heir to the throne. The Anglo-Saxon King, Harold Godwinson, became his successor, which led to a three-way battle between the King, Harald Hardrada (the Viking king of Norway) and William, the Duke of Normandy. Harald Hardrada was killed at the Battle of Stamford Bridge, leaving King Harold and the Anglo-Saxons, and William and the French-Normans to fight for the crown. The Battle of Hastings took place on 14th October, 1066. The Saxons created a shield wall of which the Normans spent most of the battle trying to defeat. Thinking the Normans were retreating, the Saxons left broke the shield in order to chase them, a mistake as the Normans has lured them away in order to kill them. Harold Godwinson was killed and the Normans defeated. William took the throne and was given the nickname William the Conqueror. The battle is famously shown on the Bayeux Tapestry.

Mintage for the 2016 Battle of Hastings 50p circulation coin that you will find in your change is 6,700,000. BU coins are struck twice to achieve a higher definition.

We received our first delivery on 18th November, 2015.

If you are interested in collecting fifty pence coins, read our blogs:

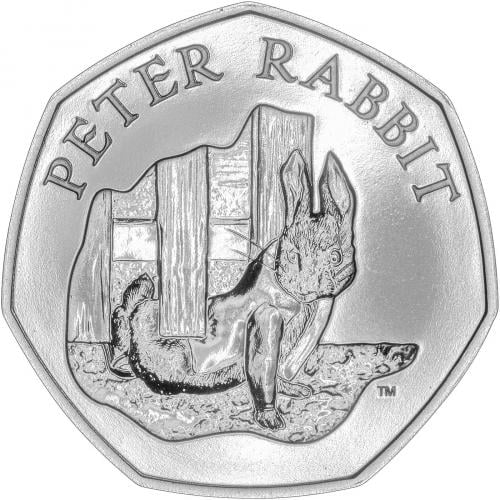

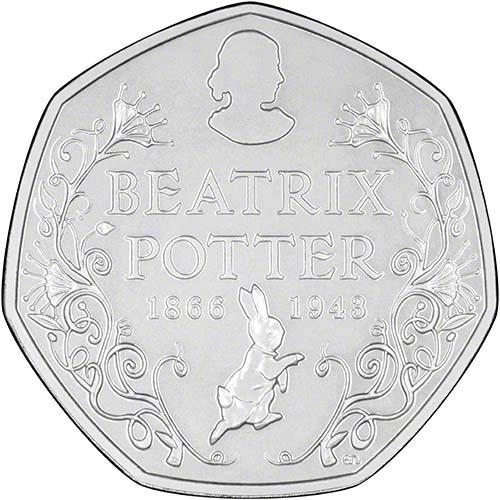

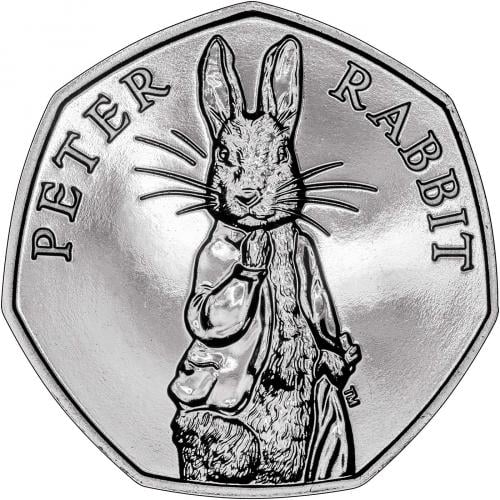

Beatrix Potter 2017 Fifty Pence Coins

Introducing the 2017 The Tale of Peter Rabbit Fifty Pence Coin

Obverse

The obverse features the fifth definitive portrait of Queen Elizabeth II by Jody Clark.

Reverse

The reverse of the coin was designed by the Royal Mint engarver, John Bergdahl. It features King Harold and the famous fate he is believed to have suffered - an arrow in the eye.

Specification

| Denomination | 50p |

| Alloy | Cupro-Nickel |

| Quality | Brilliant Uncirculated |

| Diameter | 27.30mm |

| Weight | 8g |

| Reverse Designer | John Bergdahl |

| Obverse Designer | Jody Clark |

| Mint | The Royal Mint |

2024 Christmas Opening Hours and Despatch Dates

General

- Tuesday 24th December 2024 - Phone lines 9:30 - 14:00 (Last showroom appointment 12:00pm - Collections Only).

- Wednesday 25th December 2024 - Wednesday 1st January 2025 - Closed (Urgent enquiries will still be answered during this time).

- Thursday 2nd January 2025 - Normal Business Hours.

- All orders placed between Friday 20th December 2024 and Wednesday 1st January 2025 will be despatched between 2nd - 5th January 2025.

Hatton Garden

- Closed 20th December 2024 - 5th January 2025 inclusive.

Christmas Despatch 2024

- Last despatch date for UKSTANDARD orders in time for Christmas – Monday 16th December.

- Last despatch date for UKSPECIAL orders over £5,000 in time for Christmas – Thursday 19th December.

- Last despatch date for UKSPECIAL orders below £5,000 in time for Christmas & UKSTANDARDS orders not in time for Christmas – Friday 20th December.

Internationals

- Last despatch date for international orders in time for Christmas – Monday 2nd December.

- Last despatch date for all internationals – Monday 16th December.

Distance Buy-Ins

- Distance Buy Ins (DBI) – Last despatch date for DBI packaging – Packaging shipped out Monday 16th to arrive with customer Tuesday 17th to be collected by DPD Wednesday 18th to arrive with us Thursday 19th.

New Year

- First despatch date in the New Year – Thursday 2nd January 2025.

Delivery Information

We aim to dispatch orders within 48 hours of receiving cleared funds. Our standard delivery methods are as follows.

Orders over £60 - Fully Insured Delivery.

- Within the UK and BFPO - Next day fully insured and tracked. Delivery starts from £6.

Orders under £60

- Within the UK and BFPO - Royal Mail 2nd Class. Your order will normally arrive within 2-3 working days. Delivery starts from £3.50.

If you wish to have your order sent by an alternative method (e.g., Saturday Guaranteed) please contact +441253343081 for more information. Please note, we will not dispatch high value orders over a bank holiday weekend.

For international delivery, please check with your local customs office for more information on custom duty and taxes.

Full delivery information can be found by clicking here.

Postal Insurance

We offer fully insured delivery on all special delivery options. We do need to pass on the cost of this insurance as it soon adds up shipping high value gold and silver products.

- Orders under £1500 there is no additional fee.

- Orders over £1500 we charge a fee in order to cover the increasing costs of insurance. For every £1500 we apply a £1 fee.

If you require any assistance, please do not hesitate to call the showroom on +441253343081 and one of our team can discuss your purchase.

Terms of Sale - Key Points

You can find more information on payment and identification requirements.

Bullion coins are provided as is and on occasion may have some minor scratches or edge knocks. These are not regarded as faulty or damaged goods as their precious metal content and value as a bullion coin is not affected. Any coin sold for a value less than a 180% intrinsic is considered a bullion coin.

Gold investment products are VAT free. Silver investment products are inclusive of VAT at the current rate unless otherwise stated.

All investment products are based on the live precious metal price. Prices will be fixed once the item has been added to the basket and recalculates just before checking out.

If your product is not a graded coin and is considered a bullion item, it should be noted that these are bought and sold on low premiums over their precious metal content and not solely for aesthetic purposes; therefore, some products may have edge knocks and/or marks. These edge knocks and marks do not alter the specifications of the coins.

Please note that all investment products are exempt from the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013 and therefore customers do not have the right to cancel their order once the order has been accepted. If customers no longer wish to go ahead with their investment purchase, there is an option to sell the products back to Chard (1964) Ltd instead. View our current buy back prices.

View our full Terms & Conditions.