Bank of England Raises Interest Rates to 5% As Inflation Remains at 8.7%

Synopsis

As UK inflation skyrockets and the Bank of England raises interest rates to 5%, investors face mounting challenges. Discover why turning to gold and exploring alternative investments is crucial to safeguarding wealth in the face of soaring inflation. Don't miss out on valuable insights to navigate these uncertain times!

Key Takeaways

- The new Bank of England base rate is 5%

- Bank of England increased interest rates for the 13th consecutive time

- Core inflation (excluding energy, food, alcohol, and tobacco) reached a 31-year high at 7.1% in May 2023

- Consumer Price Index (CPI) showed price increases in air travel, second-hand cars, and recreational/cultural goods

- Decrease in petrol costs and slight easing in food prices

- Food prices have risen since May 2022, with granulated sugar seeing an increase of over 50%

- Brexit is considered as a possible factor for high inflation rates in the UK

BOE Interest Rates Increased for 13th Consecutive Time

On 22nd June, 2023, the Bank of England (BOE) increased interest rates by another 0.5 percentage points, lifting them to 5%. The BOE decision to raise interest rates to 5% is based on the May 2023 inflation rate, which remained unchanged (8.7%) compared to April 2023. This decision came after a percentage point increase in May 2023, which saw interest rates go from 4.25% to 4.5%.

| Date | Rate % | Percentage Point Change |

| 19-Mar-20 | 0.10% | - 0.15% |

| Dec-21 | 0.25% | + 0.15% |

| Feb-22 | 0.50% | + 0.15% |

| Mar-22 | 0.75% | + 0.25% |

| May-22 | 1% | + 0.25% |

| Jun-22 | 1.25% | + 0.25% |

| Aug-22 | 1.75% | + 0.50% |

| Sep-22 | 2.25% | + 0.50% |

| Dec-22 | 3.50% | + 1.25% |

| Feb-23 | 4% | + 0.50% |

| Mar-23 | 4.25% | + 0.25% |

| May-23 | 4.50% | + 0.25% |

| Jun-23 | 5.00% | + 0.50% |

Bank of England Base Rate Increases Since March 2020

UK Inflation Remains at 8.7%

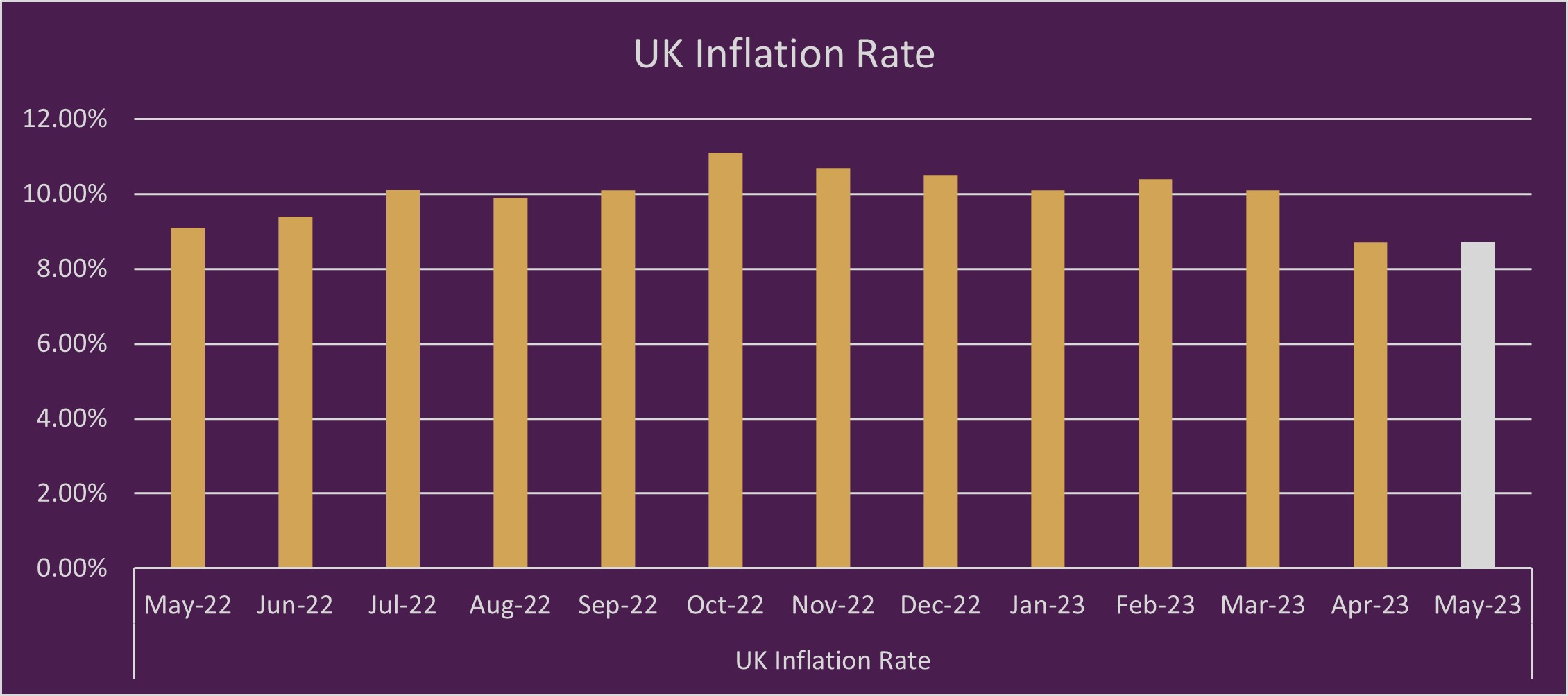

In May, the inflation rate in the UK remained at 8.7%, the same as the rate in April. However, in April 2023, the nation experienced the most significant decline in inflation since the crisis started, with the annual rate dropping to 8.7% from an astonishing 10.1%. This outcome was unexpected by expert economists, who had anticipated a drop in inflation to 8.4% by this stage.

Breakdown of the Consumer Price Inflation UK - May 2023

The rate is still above the BOE target of 2% inflation. Therefore, due to inflation remaining at 8.7%, the BOE has exerted additional pressure on policymakers to sustain the bank's ongoing efforts to tighten monetary policy. In May 2023, the Core Consumer Price Index (CPI) witnessed price increases in air travel, second-hand cars, recreational and cultural goods (such as live music events and computer games), all contributing to the heightened rate hike. However, these rising prices were offset by the decrease in petrol costs, and food prices experienced a slight easing to 18.3% compared to April 2023.

Food Price Increases Since May 2022

This diagram illustrates the rise in food prices, depicting the recent May 2023 CPI food costs and the corresponding increase they have witnessed since May 2022. Food prices fell to 18.3% from April 2023 19% but are upwards of 50% higher for granulated sugar!

Core Inflation Hits 31 Year High

According to The Office for National Statistics (ONS), the Core Consumer Price Index in the United Kingdom, which excludes energy, food, alcohol, and tobacco, increased by 7.1% in the 12 months leading up to May 2023. This figure rose from the previous rate of 6.8% observed in April, marking the highest level since March 1992. Moreover, in April 2023, a two-year fixed mortgage deal stood at 6.15%. Following the rise in May CPI, the standard variable rate has subsequently reached 7.52% in June 2023.

Is Brexit to Blame for High Inflation Rates in the UK?

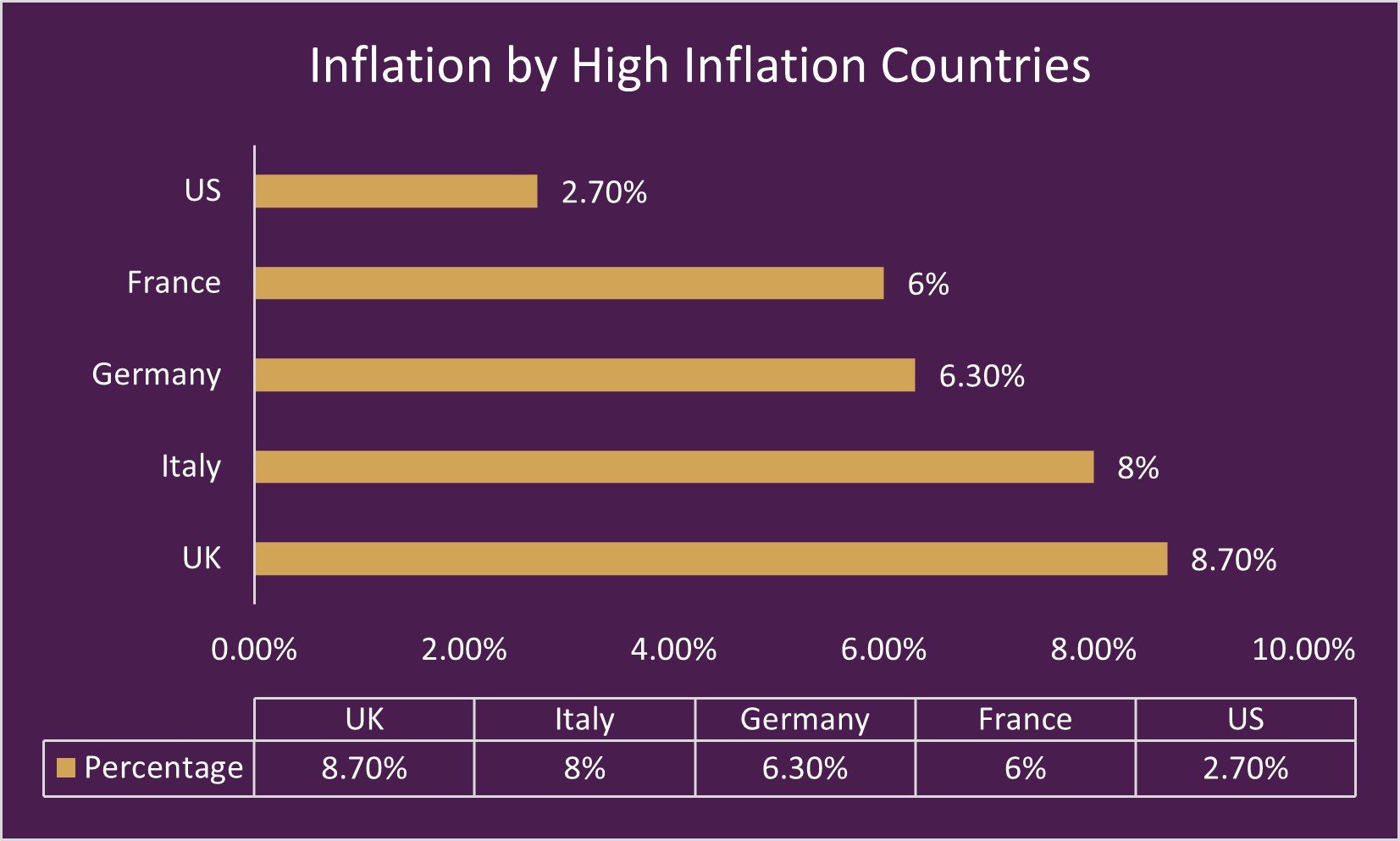

The global repercussions of Russia's invasion have reverberated through food and energy costs. However, inflation in the UK has surged at a quicker pace and proven more resilient compared to the United States and the European Union. While some, like Mark Carney, the former governor of the Bank of England, attribute this to Brexit, the situation is multifaceted.

Gold as Hedge Against Inflation

Gold investing offers an advantage by serving as a hedge against inflation, as its price tends to rise when the cost of living increases. Inflation denotes the overall rise in the prices of goods and services, resulting in a reduction in the purchasing power of currency.

Chards Mailing List is the ultimate mailing list for bullion dealers that customers need to be on if they are interested in investing in precious metals. Our mailing list is the only one you'll ever need to stay informed about the latest deals, special offers, and product releases. We keep our subscribers updated on everything from investment-grade bullion to rare and collectible coins. By signing up for our emails, customers will never miss out on any fantastic deals or exciting news in the bullion market. Our mailing list is an essential tool for those looking to stay informed and make informed investment decisions.

Interested in signing up today? Sign up to our mailing list and follow us on Instagram, YouTube, Facebook, TikTok and Twitter for coin news.

Related Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.