10 Tolas Gold Bar Swiss Bank

Buy 10 Tola gold bar. This gold bar contains exactly 10 Tola (3.75 troy ounces) of pure 24 carat gold, struck in 99.9 fineness. These investment bars are stamped and guaranteed by a LBMA approved refiner.

More Info

Terms & Delivery

Related Blogs

The Tola is an Indian measurement unit which equates to 0.375 troy ounce. The Tola is a popular denomination for gold bars in India, Pakistan and far eastern countries. Tola bars are the favourite choice during Diwali, we don't always have them in stock so make sure you snap these up quickly.

If you are looking for more flexibility, we have a range of gold bars, from 1kg to 1g, we have something for every gold investor.

Specification

| Metal | Gold |

| Weight / Size | 10 Tola |

| Gold Weight Troy Ounces | 3.75 |

| Fineness / Carat | 0.999 / 24 |

| Mint / Brand | Swiss Bank |

2024 Christmas Opening Hours and Despatch Dates

General

- Tuesday 24th December 2024 - Phone lines 9:30 - 14:00 (Last showroom appointment 12:00pm - Collections Only).

- Wednesday 25th December 2024 - Wednesday 1st January 2025 - Closed (Urgent enquiries will still be answered during this time).

- Thursday 2nd January 2025 - Normal Business Hours.

- All orders placed between Friday 20th December 2024 and Wednesday 1st January 2025 will be despatched between 2nd - 5th January 2025.

Hatton Garden

- Closed 20th December 2024 - 5th January 2025 inclusive.

Christmas Despatch 2024

- Last despatch date for UKSTANDARD orders in time for Christmas – Monday 16th December.

- Last despatch date for UKSPECIAL orders over £5,000 in time for Christmas – Thursday 19th December.

- Last despatch date for UKSPECIAL orders below £5,000 in time for Christmas & UKSTANDARDS orders not in time for Christmas – Friday 20th December.

Internationals

- Last despatch date for international orders in time for Christmas – Monday 2nd December.

- Last despatch date for all internationals – Monday 16th December.

Distance Buy-Ins

- Distance Buy Ins (DBI) – Last despatch date for DBI packaging – Packaging shipped out Monday 16th to arrive with customer Tuesday 17th to be collected by DPD Wednesday 18th to arrive with us Thursday 19th.

New Year

- First despatch date in the New Year – Thursday 2nd January 2025.

Delivery Information

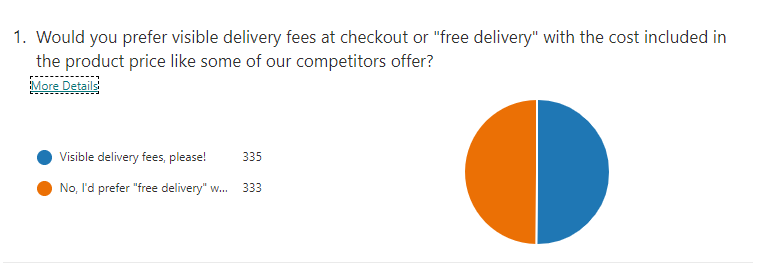

We aim to dispatch orders within 48 hours of receiving cleared funds. Our standard delivery methods are as follows.

Orders over £60 - Fully Insured Delivery.

- Within the UK and BFPO - Next day fully insured and tracked. Delivery starts from £6.

Orders under £60

- Within the UK and BFPO - Royal Mail 2nd Class. Your order will normally arrive within 2-3 working days. Delivery starts from £3.50.

If you wish to have your order sent by an alternative method (e.g., Saturday Guaranteed) please contact +441253343081 for more information. Please note, we will not dispatch high value orders over a bank holiday weekend.

For international delivery, please check with your local customs office for more information on custom duty and taxes.

Full delivery information can be found by clicking here.

Postal Insurance

We offer fully insured delivery on all special delivery options. We do need to pass on the cost of this insurance as it soon adds up shipping high value gold and silver products.

- Orders under £1500 there is no additional fee.

- Orders over £1500 we charge a fee in order to cover the increasing costs of insurance. For every £1500 we apply a £1 fee.

If you require any assistance, please do not hesitate to call the showroom on +441253343081 and one of our team can discuss your purchase.

Terms of Sale - Key Points

You can find more information on payment and identification requirements.

Bullion coins are provided as is and on occasion may have some minor scratches or edge knocks. These are not regarded as faulty or damaged goods as their precious metal content and value as a bullion coin is not affected. Any coin sold for a value less than a 180% intrinsic is considered a bullion coin.

Gold investment products are VAT free. Silver investment products are inclusive of VAT at the current rate unless otherwise stated.

All investment products are based on the live precious metal price. Prices will be fixed once the item has been added to the basket and recalculates just before checking out.

If your product is not a graded coin and is considered a bullion item, it should be noted that these are bought and sold on low premiums over their precious metal content and not solely for aesthetic purposes; therefore, some products may have edge knocks and/or marks. These edge knocks and marks do not alter the specifications of the coins.

Please note that all investment products are exempt from the Consumer Contracts (Information, Cancellation and Additional Charges) Regulations 2013 and therefore customers do not have the right to cancel their order once the order has been accepted. If customers no longer wish to go ahead with their investment purchase, there is an option to sell the products back to Chard (1964) Ltd instead. View our current buy back prices.

View our full Terms & Conditions.

If you are interested in investing in gold, you may be interested in reading our blogs: