What Is Investment Gold?

Synopsis

Gold is a valuable form of investment that can provide a hedge against inflation, currency devaluation, and geopolitical risks. It is a finite resource and is not affected by the same economic and political factors as other assets. It can also be a good diversifier in a portfolio. However, it's always best to consult with a financial advisor before making a decision.

Definition of Investment Gold

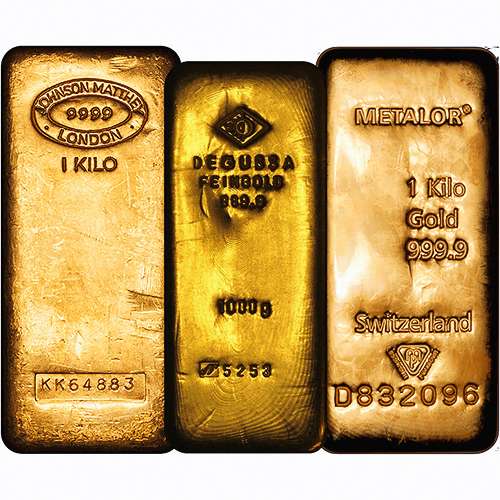

For the purpose of VAT exemption, "Investment Gold" is defined as per HMRC Notice 701/21 as either:

(a) gold of a purity not less than 995 thousandths that is in the form of a bar, or a wafer, of a weight accepted by the bullion markets.

(b) a gold coin minted after 1800 that is:

- of a purity of not less than 900 thousandths.

- (or has been) legal tender in its country of origin.

- of a description of coin that is normally sold at a price that does not exceed 180 per cent of the open market value of the gold contained in the coin.

(c) an investment gold coin as specified in Investment gold coins (VAT Notice 701/21A).

Why is Gold Used for Investment Purposes?

Investment gold is a form of precious metal used purposefully as a store of value and wealth. It is widely considered one of the safest and most reliable forms of investment due to its unique properties. For example, gold is a tangible asset that is not necessarily affected by the same economic and political factors that can impact other forms of investment. It is also a finite resource, meaning that there is a fixed amount available to be mined from the Earth and new gold metal cannot simply be manufactured. This helps to maintain its value over time.

Gold as a Hedge Against Inflation and Currency Devaluation

One of the main reasons why gold is used as an investment is its ability to act as a hedge against inflation and currency devaluation. In effect, it can provide shelter for investors in times of economic instability. Inflation is when the cost of goods and services increases over time, which can erode the value of money. Currency devaluation is when the value of a currency decreases in relation to other currencies. Gold, however, tends to retain its value even when wider economies are struggling, and it can even increase in value during times of economic uncertainty. This makes it an attractive option for those looking to protect their wealth from inflation and currency devaluation.

Gold as a Hedge Against Geopolitical Risks

Another reason why gold is used as an investment is that it acts as a hedge against geopolitical risks. The price of gold is often affected by political events and instability. The recent war between Russia and the Ukraine is a prime example, where the price of gold increased significantly. When a country is facing a political crisis, the value of its currency may decrease and its citizens may turn to gold as a way to protect their wealth. This is because gold is a global asset that is not tied to any specific country or government. It is not controlled by any central bank or government in the same way as a currency, thus it is not subject to the same economic and political risks as other assets.

Gold as a Diversifier in a Portfolio

Gold can also be a good diversifier in a portfolio. Diversification is a risk management strategy that involves spreading investments across different asset classes. Gold can provide a good balance to a portfolio that is primarily made up of stocks and bonds, in part because gold tends to perform differently than other assets and can help to reduce the overall volatility of a portfolio. As a result, its price tends to move independently of other investments, which can provide a hedge against market downturns.

Ways to Invest in Gold

There are several ways to invest in gold, including buying physical gold in the form of coins or bullion from a reputable dealer, and purchasing shares in a gold exchange-traded fund (ETF). Each option has its own set of pros and cons and should be carefully considered based on the individual's investment goals and risk tolerance. You can read more about the advantages and disadvantages of different forms of bullion in our guide page.

Summary

In conclusion, gold is a unique and valuable form of investment that can provide a hedge against inflation, currency devaluation, and geopolitical risks. Its finite nature and its ability to retain value during economic uncertainty makes it an attractive option for those looking to protect their wealth and diversify their portfolio. As with any investment, it's always best to consult with a financial advisor before making a decision.

Notes & Clarifications

Perhaps the most commonly misunderstood part of the investment gold definition is the “180% rule” and what “normally sold” means. However, this is clarified in section 2.4 of HMRC Notice 701/21:

The normal selling price of coins is influenced by the finish. Investment gold coins fall into two broad classes. The first consists of relatively older issues made to circulate as currency. The second, generally more recent, were primarily produced as a store of wealth. The first will normally be worn from circulation. The second type may have been issued in a number of finishes and if the majority of a type of coin are for example ‘brilliant uncirculated’ quality then, other things being equal, the brilliant uncirculated value will reflect the normal selling price. On the other hand, if the majority of a particular coin are ‘proof’, then the value of the proof coin will more likely reflect the ‘normal’ selling price. The test of normal selling price must take into account these factors and be based on the condition in which the gold coin type is most frequently traded.

Many people misinterpret it as applying to each individual coin, rather than to the type of coin as a whole.

As an example:

If we ask for £100K for an 1841 MS 70 gold sovereign, then that is clearly more than an 80% premium. However, because it is a gold sovereign, and gold sovereigns "normally" sell for a small premium, then it qualifies as "investment gold".

It is also irrelevant whether a coin is bullion or proof. A proof sovereign is still a sovereign.

VAT Exemption

From 1st January 2000, investment gold became exempt from VAT in the United Kingdom due to an EU directive.

Identification

Please be aware that for callers to our showroom who wish to buy investment gold, we must see two forms of identification. Please see our identification page for further details.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.