Gold's Historical and Ongoing Performance

Synopsis

Gold is a valuable investment option, known for its performance during economic uncertainty and as a hedge against inflation. However, it also comes with drawbacks such as lack of income and high storage costs. It is recommended to consult with a financial advisor before investing in gold and to allocate a small percentage of one's portfolio towards it.

Introduction

Gold has long been prized as a symbol of wealth and prestige, and as a valuable investment opportunity. This precious metal has stood the test of time, retaining its allure and appeal throughout history. In this article, we shall explore the historical context, present market conditions and the potential future of investing in gold.

Defining Gold as an Investment

To begin, let us define gold as an investment. Gold is a tangible asset, meaning it can be physically held, that can be acquired in a variety of forms such as coins, bars, and exchange-traded funds (ETFs). It is often considered a safe haven during periods of economic instability, as well as a hedge against inflation. Additionally, gold has a timeless beauty and is often utilized in the creation of jewelry, art, and other decorative pieces.

Historical Performance of Gold

The history of gold as an investment can be traced back to ancient times. Civilizations such as the Egyptians and Greeks employed gold as a means of exchange, using it to trade goods and services. The first gold coins were minted around 700 BCE by the Lydians, an ancient civilization located in modern-day Turkey. In terms of historical performance, gold has been known to perform well during times of economic uncertainty and turmoil. During stock market crashes or periods of economic instability, investors often seek refuge in gold as a safe-haven asset. For instance, during the 2008 financial crisis, the price of gold experienced a substantial increase as investors sought stable investments. Conversely, during periods of economic growth and stability, the price of gold tends to decrease.

Comparison with Other Investment Options

In comparison to other investment options, the performance of gold over the long-term is varied. Historically, stocks and real estate have tended to perform better than gold. However, gold has outperformed bonds and cash in certain periods. It is worth noting that gold is not typically a conventional inclusion in a diversified investment portfolio, and we for one cannot understand this outlook. Once you have wealth this needs locking in and we beleive gold is the best vehicle for this purpose.

Ongoing Performance and Factors Affecting Gold's Price

Currently, the primary drivers of gold's price are supply and demand. When demand for gold is high, the price generally rises, and when demand is low, the price falls. Factors that can influence demand include economic growth, inflation, political instability, and interest rates. The cost of mining gold is also a factor, as it impacts the amount of gold available on the market. At present, gold market trends remain positive, with prices gradually increasing over the past year. The COVID-19 pandemic has led to increased economic uncertainty and volatility in the stock market, resulting in a heightened demand for gold as a safe-haven asset. Additionally, ongoing geopolitical issues and uncertainty surrounding the US dollar are also contributing to the upward trend of gold prices.

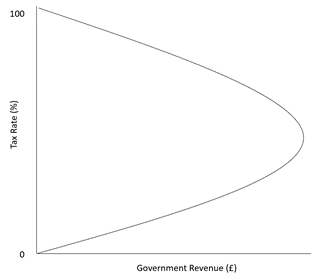

Gold Price Going Up or Down?

We can't predict the future. So, we don't know whether gold will be higher or lower than now, at any particular time in the future. In actual fact, we believe gold will tend to increase in price over the long term, but we try to be conservative and honest in our advice.

Many people seem to buy gold only when it appears to them to be increasing in price, and often only when they see favourable press comment. Most of the time it would actually be more sensible to buy after gold had just gone down in price. Clearly, this risks missing the boat if the price just continues to go up, but in gold as in most markets there are continual price fluctuations in both directions even when there is a strong trend in one direction.

Strangely enough, we tend to see favourable financial press comment about gold while it has been going up, and unfavourable comment when it has been going down.

Conclusion

Lastly, it is important to note that gold is not a traditional diversified investment and should not constitute a significant portion of an investment portfolio. Most financial experts recommend allocating a moderate percentage, such as 5-10%, of an investment portfolio to gold as a safeguard against inflation or market volatility. In conclusion, gold has a rich historical tradition as a store of wealth and a safe-haven asset and continues to be a highly sought after investment opportunity. Prospective investors should carefully consider their risk tolerance and investment goals before investing in gold. It is always advisable to seek the guidance of a financial advisor and conduct extensive research prior to making any investment decisions.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.