What Is the Gold Standard?

Synopsis

Many economists and nearly all politicians recoil at the mere mention of a return to the gold standard. This is often due to either a misunderstanding of a gold standard or a general dislike of sound money.

Throughout history, gold and silver have been used as either money itself, or as the yardstick for a national currency. The characteristics of gold (durability, scarcity, distinctiveness etc.) mean it is not easy to counterfeit. But that’s not to say people haven't tried.

The Byzantine empire flourished for centuries until the dilution of the coinage, by reducing the gold content, brought international financial chaos and an end to the “one reliable medium of exchange” the world had.

Key Takeaways

- Historically, the gold standard served as an economic model, with currencies linked to gold, ensuring stability.

- During the period from 1821 to 1914, the classical gold standard established monetary units based on gold, facilitating the circulation of both gold coins and banknotes.

- The gold standard was abandoned during World War I and led to the gold exchange standard, with the US dollar as a key currency.

- Attempts to return to a gold standard, such as the Smithsonian Agreement, ultimately failed, and the gold standard was abandoned in favour of fiat currencies.

Definitions of The Gold Standard

Below, you'll find definitions and key insights into the gold standard:

HMRC's Definition

CFM12050 - Understanding corporate finance: foreign exchange: fixed exchange rates

The history of exchange rates: fixed rates

Concern about exchange rates is a relatively new phenomenon in the history of trade and commerce. From classical antiquity, gold and silver provided a common medium of exchange throughout Europe and the eastern Mediterranean. For example, a 14th-century English merchant selling wool to Flanders would exchange the wool for a quantity of gold or silver coins. If he wanted to know how much the unfamiliar coins were worth in terms of English sovereigns, he could weigh the coins and assay the purity of the metal to determine what weight of pure gold or silver they represented. Money changers could quote fixed rates of exchange between the bewildering variety of coins in circulation in various parts of Europe.

From the late 14th century, bankers began to issue paper notes in lieu of gold or silver, so that merchants did not have to carry trunk-loads of coins around. The value of paper money was still tied to precious metals; each note was theoretically redeemable by the government concerned for a set weight of gold or silver. This amount changed only infrequently, traders rarely had to worry about foreign exchange fluctuations affecting their profits.

Full gov.uk Source

Bank of England - 17th Century

In 1797 the drain on the Bank's gold reserves made it necessary to stop paying out gold in exchange for the Bank's notes. This "Restriction Period" lasted until 1821.

Wikipedia - 19th Century

In 1844, the Bank Charter Act established that Bank of England Notes, fully backed by gold, were the legal standard. According to the strict interpretation of the gold standard, this 1844 act marks the establishment of a full gold standard for British money.

Economics Explanation of The Gold Standard

The Basics of a Gold Standard

To many people the idea of carrying gold coins in their pockets or a wallet or purse etc., would be ridiculous. A simpler solution would be to have a certificate or receipt that could be transferred or exchanged on demand for a specified amount of gold. This is, how many banks, and “gold warehouses” would operate.

Despite being a well-known critic of the gold standard, Milton Friedman actually gave one of the most concise descriptions of a gold standard. Friedman said:

"A real, honest-to-God gold standard has many advantages. If such a standard could exist, it would be one in which gold was literally money, and money literally gold, under which transactions would literally be made in terms either of the yellow metal itself, or of pieces of paper that were 100 per cent warehouse certificates for gold."

Under this kind of system, Friedman explained, irresponsible monetary policy would be curtailed by the discipline of the gold standard. The kind of gold standard that countries have operated under have been much different.

Gresham’s Law

A concept often used in economic circles is Gresham’s Law, named after English financier Sir Thomas Gresham (1519-1579). The law, implies simply that “good money drives out bad money”, is perhaps more accurately described “artificially overvalued money tends to drive an artificially undervalued money out of circulation”. This can be explained when looking at the differences between the nominal or face value of a gold coin when compared with its intrinsic metal value.

For example, a gold sovereign is considered to have a nominal value of £1 sterling. It’s intrinsic value, or the value of its metal content is around £340. It would be inconceivable that someone would pay £5 for a pint of beer with 5 gold sovereigns. That would be around £1,700!! Instead, they will most likely hold on to them, removing them from circulation; and instead use a piece of paper that says “I promise to pay the bearer on demand the sum of five pounds”. The sovereign, is therefore undervalued by its £1 denomination, whereas the £5 banknote is now overvalued

.

Sir Thomas Gresham

The Gold Standard (1821-1914)

The system which most people would be familiar with would be the standard used in the period from 1821-1914, which is often referred to as the “classical” gold standard. The main characteristics were:

- The monetary unit being defined as a weight of gold.

- Bank notes were redeemable in gold on demand

- Gold coins and bank notes are both in circulation

Between 1834-1933, the US dollar was legally defined as 1/20th of an ounce of gold or $20 per ounce. Likewise, ¼ ounce of gold was known as £1.

There is an important distinction to make. This is not to say that 1/20th of an ounce of gold was worth one dollar or ¼ ounce was worth £1. The dollar and pound were used to define a specific weight of gold, just like one yard is defined as 0.9144 metres or 1 fluid ounce is equal to 29.57 millilitres. Understanding this distinction between the different currencies’ relationships with gold means that they are not as different as we would sometimes believe. All were defined as a specified gold weight, so currencies too could be exchanged with the understanding that any of them would be redeemable at face value.

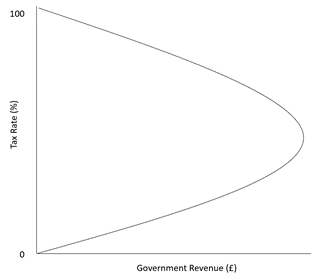

The money supply, whether gold or claims to gold, is therefore more-or-less constant depending on inflows of new gold. As this supply is “fixed”, prices tend to lower over the long term as technological advances improve the production process and lower costs.

The Gold Standard Abandoned (1914)

The First World War saw the link with gold broken again, and increases in the issue of unbacked or fiduciary currency. (On this occasion the low denomination notes were issued by the Treasury rather than by the Bank.) In the UK, pounds were now only redeemable in large gold bars rather than in the coins that were in everyday use leading up to the war. These were only used for large, often international, financial transactions and were often way out of reach for the average person.

The US dollar, however was still redeemable in gold, so many European countries, rather than holding gold, held dollars or other gold-convertible currencies which were at least in some respects, “as good as gold”. This was known as a gold exchange standard. After the war, in 1925, an attempt was made to return to the discipline of the gold standard, but this proved unsustainable and the gold standard was finally abandoned in 1931.

The Great Depression (1929-39)

Inflationist policies only increased during the financial collapse as governments attempted to dig themselves out of a hole, by digging further. Bank runs developed in the US and Europe as depositors and creditors began to withdraw their balances. On July 14th 1931 all banks in Berlin were closed by a government decree and the knock-on effect soon hit London.

Throughout this period and long after, gold and the gold standard became the supposed cause of the financial crisis. As Lionel Robbins explained the common sentiment:

"The experience of these years shows the Gold Standard as such to be a generator of instability. It was on the Gold Standard that the American boom was generated, it is urged. It was adherence to the Gold Standard which was responsible for the economic difficulties of Great Britain. It was the Gold Standard which engendered this great mass of floating balances which eventually brought the whole structure to disaster. Experience is conclusive against the Gold Standard".

The Bretton Woods Agreement (1944-1971)

Towards the end of World War II, world leaders established an economic model led by the US, involving tying currencies to a gold standard. Following the devastating effects of the 1930s and World War II, Germany's Chancellor Konrad Adenauer and Economics Minister Ludwig Erhard implemented a laissez-faire approach that revitalised the German economy, earning it the nickname "Wirtschaftswunder" or the "economic miracle." Meanwhile, the US aimed to restore a stable international monetary system, introducing a standard similar to the gold exchange standard, with the US dollar as the key currency, valued at 1/35th of an ounce, and only redeemable in gold by foreign governments and central banks.

The Bretton Woods Agreement, named after the location where it was established, required foreign nations to peg their currencies to the US dollar, which remained tied to gold. As a result, foreign countries held dollar reserves, while the US held gold reserves. Over time, many currencies became overvalued, leading to a world dollar shortage and increased inflation. By the late 1960s, Western European countries and Japan sought to redeem their overvalued dollars for gold at $35 per ounce, depleting the US gold stock and leading to the eventual collapse of the Bretton Woods standard in 1971 when the US abandoned the gold standard, causing other countries to follow suit.

Despite initial efforts to control the gold price, it soared in the free market, reaching around $125 per ounce by 1973.

Return to Gold Standard?

Once Bretton Woods finally collapsed, there were further attempts to establish an international monetary system, but this time, with no gold connection whatsoever.

The Smithsonian Agreement was a pledge to maintain fixed exchange rates among the world’s currencies. With many currencies already undervalued against the dollar, the excess of Europe’s dollar reserves along with the dollar devaluation, the free-market gold price was driven to $215 and ounce. The Smithsonian Agreement collapsed in February 1973, a little over a year after it was implemented.

On 7th November 2010 Robert Zoellick, President of the World Bank, told the Financial Times, "The system should also consider employing gold as an international reference point of market expectations about inflation, deflation and future currency values. Although textbooks may view gold as the old money, markets are using gold as an alternative monetary asset today".

Some immediately mistook this as a call to return to a Gold Standard, which attracted ridicule from some quarters.

Where to Buy Gold In the United Kingdom?

Are you interested in purchasing gold? Explore our affordable investment gold bullion options today, including our 2024 Gold Bullion Coins range and our gold bars.

Stay informed by signing up for our mailing list and following us on Instagram, YouTube, Facebook, TikTok, Twitter, and Threads for the latest updates on special offers, new stock, and much more.

Sign up to our newsletter:

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.