How to Buy Gold Coins and Bars

Synopsis

We are not financial advisors and we would always recommend that you consult with one before making any major investment. We can only give advice on what the best deals are from Chards, which match your budget and investment portfolio at the time you make enquiries. We try to keep our investment advice very simple. We cannot predict with any certainty what gold or any other commodity or currency will do over short, medium or long periods of time. Howver, there are some areas where we have considerable experience and feel we can safely give our thoughts. Some of it may appear obvious, but it is surprising how often we find ourselves repeating it.

Buy in the Cheapest Form

This is one of the most obvious pieces of advice we give. But we usually add "within reason".

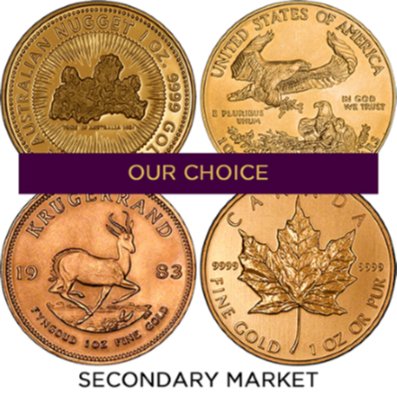

Generally, the cheapest ways to buy gold; are 1kg gold bars, Best Value Our Choice one ounce gold coins, Britannias or sovereigns. Often, the bigger the size or quantity, the lower the premium. Remember to compare premiums instead of prices for the best deal. Of these options, large gold bars can usually be bought for the lowest premium, followed by Our Choice 1 oz gold coins, Britannias and then gold sovereigns. In the past, we would have advised that most other gold coins are more expensive, and therefore better avoided. However, some mints, such as the Perth Mint, now produce coins for fairly low premiums. It is also worth keeping an eye on our website, as we usually have special offers on coins we have excess stock of. Conversely, we believe that sovereigns are worth paying a slight extra premium for, as their smaller size gives you more flexibility when selling, and they have historic and aesthetic value which you get for next to nothing. Our advice will change with changes in the market, but generally we believe the most effective ways of investing in physical gold are:

Gold Sovereigns

Sovereigns are a smaller, more attractive, more historic, and probably better known coin than Krugerrands. Therefore, we believe it is worth paying a slight extra premium over and above Krugerrands, to buy sovereigns. If you can buy sovereigns for about 2% differential above Krugerrands, we believe this makes them a better long term buy. Currently, for investors buying at least 50 sovereigns, the differential above Krugerrands is under 2%, sometimes as low as 1%, and this makes them our first choice. Naturally this is slightly subjective, and reflects our personal opinion. Consider though that if you were to buy sovereigns at our 100 piece rate, you could resell them privately in singles at 10% profit, and they would be very competitively priced. You could not make the same claim for Krugerrands.

Sovereigns also have the advantage of being exempt from C.G.T. (Capital Gains Tax) in the UK.

Krugerrands

Krugerrands are the best known of all the modern one ounce gold bullion coin. They are available in greater quantities, and they can generally be bought at lower prices than any other one ounce bullion coins. This fact alone makes them one of the best 1 ounce bullion coins to consider purchasing. True they are not particularly attractive, and don't possess much in the way of historical interest, but their production quality is consistently high, and they are a very cost effective way for small investors to buy gold. They are also easy to compare prices of, as they contain exactly one ounce of fine gold.

Gold Bars

Although, at a quick look, gold bars may seem the cheapest way to invest on physical gold, there are some points worth noting, and some drawbacks. Our price for a single one ounce bar is usually exactly the same as for a single one ounce Krugerrand. Buy two Krugers though, and our quantity price breaks make Krugerrands cheaper, and therefore a better buy. Also while it is true that larger bars, such as one kilo sell for a lower percentage premium than Krugerrands, they are not as easy to resell. Only a specialist gold dealer is likely to give you a good purchase price for gold bars, and then often with less enthusiasm than for Krugerrands, sovereigns, or other highly marketable coins. This restricts your choice of buyer, and most dealers would expect to pay slightly less for gold bars than for coins, expressed as a percentage of their intrinsic gold value.

If you buy large bars such as one kilo, it is not very convenient if you decide to sell a portion of it. For very large investors, it may be worth considering London Good Delivery Bars. However, despite the fact that they are usually quoted as being 400 ounce, or 12.5 kilo, bars, there is a large tolerance in their permissible weight range, from 350 to 430 ounces. There is also tolerance allowed in their purity, the minimum being .995 or 99.5% pure. Most "small" bars are .9999 purity or 99.99%. Because of these factors, 400 ounce bars are usually only traded between governments, central banks, and major bullion banks, and other professionals.

Popular Gold Bars and Coins To Buy

You can buy these products direct from this page:

1kg Gold Bar Best Value (Pre-Owned)

Stock Status - In Stock 0% £75,254.34 |

500g Gold Bar - Our Choice Pre-Owned

Stock Status - Out Of Stock 1.2% £38,078.82 |

100g Gold Bar Our Choice - Pre-Owned

Stock Status - Out Of Stock from 1.85% from £7,664.72 |

1 oz Gold Bar Best Value (Pre-Owned)

Stock Status - In Stock from 2.25% from £2,393.35 |

1 oz Gold Bullion Coin Best Value (Pre-Owned)

Stock Status - In Stock

|

1 oz Gold Bullion Coin Best Value - MintyStock Status - In Stock

|

Gold Sovereign Coin Best Value (Pre-Owned)Stock Status - Orderable

|

Gold Sovereign Bullion Coin - MintyStock Status - In Stock

|

Best Value

Coins and bars sold as "best value" or "our choice" are the lowest premium products and the best way to invest in as much gold as possible.

Lowest Price Bullion

You can view all of our best priced products in our best value section. Please note, you will be given our choice of date and mint (if applicable). You can achieve even lower premiums by buying larger gold bars in larger quantities.

Stocklists

We stock gold coins from mints from all over the world including the Krugerrand, the Maple, the American Eagle, the Australian Kangaroo, the Chinese Panda and of course, the Britannia.

Current years are often available at lower premiums compared to backdated years. This is because they are still being minted. Once a coin stops being minted they can be more difficult to source. This is not to say that you cannot get backdated coins at good bullion prices. If you sign up to our mailing list, we send out secret offers for dated coins when we have surplus stock.

Accessing Your Investment

If you are investing hundreds and thousands of pounds and have plenty in bank accounts, then the chances of you needing to sell some of your gold for an emergency is slim. However, if you are investing a few thousand pounds and only have limited funds available for emergencies, a repair to your car costing £500 may need you to dip into your investment. In this case, it is much better to sell two sovereigns than one 1oz coin or a bar and have surplus cash that you never wanted to access, leaving you with cash you may spend or have to re-invest.

Physical Gold

Most of our customers prefer to physically hold their gold investment. If you are concerned about the security risks of keeping your gold at home, we also offer a storage facility at a fee of only 0.05% per month (excl. VAT).

Tax Free Gold

The majority of gold bars and gold coins are classed as investment gold and can now be bought free of VAT in the UK and the EU since January 1st 2000. As gold sovereigns, half sovereigns, and gold Britannias, gold Lunar and gold Queen’s Beast coins, are sterling, they are treated as exempt from Capital Gains Tax (C.G.T.).

Take Me to Buy Gold!

"I would like to buy gold now," I hear you say! Well, take a look at our best priced bullion options in our best value category. Our most popular products are the bullion sovereigns, Krugerrands and one ounce secondary market gold coins.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2025. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.

.png?1542377850832)