Investing in Silver FAQ's

Synopsis

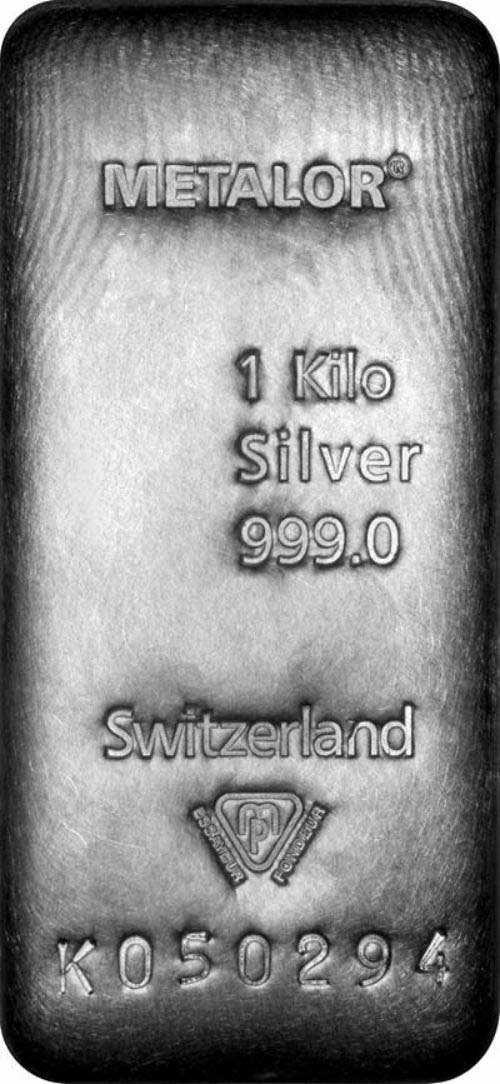

If you are looking to buy silver coins or bars online, Chards Coin and Bullion Dealer can help find the best value silver products at low premiums to expand your precious metals portfolio.

Our other popular FAQ pages offer advice on buying from and selling to Chards, whilst common questions about how to pay for silver and our delivery schedule can be found thorugh our FAQ page.

What is the Spot Price of Silver

What is the Spot Price of Silver The spot price of silver often refers to the "mid-spot price" for a given weight of silver usually given as a price per gram, per troy ounce or per kilo. It is sometimes referred to as the live price, live rate, market price or market rate. The mid-price is calculated by taking the midpoint of the ask and bid prices. We use the spot mid-price to calculate selling prices of our products.

Spot price can also refer to the "bid-spot price" or "ask-spot price" depending on the context it is used within. The "bid-price" is the wholesale market rate buyers are bidding (paying) for silver and the "ask price" is the wholesale price sellers are asking (selling) silver.

The live price of silver is featured in in our live prices tab on our navigation bar. Also if you wish to view full charts across all metals, weights and time frames please visit our metal charts page.

How Do I Invest in Silver?

Investing in silver is as simple as finding the best value coins and bars within your budget; if you are unsure which products to choose, our investment calculator can highlight recommended items from lowest premium, to CGT exempt to immediate despatch products.

Our range of silver bullion can be purchased online, in our showroom, with both collection and delivery options being available. For those new to investing we have detailed why silver makes for a sound investment, explaining the fundamentals of precious metal investing, which products to choose and why timing can play a part in your success.

How Much Silver Should I Buy?

The answer depends on your budget, tastes, appetite for risk and investment strategy.

As with any investment the widely held ideal is to buy low and sell high, in turn making yourself a nice profit. Depending on your ability to interpret market conditions and your appetite for risk you may wish to take the plunge investing all your money at once however, you sense risk you may wish to dollar cost average across a wider period.

We only recommend investing amounts that you feel comfortable with and to help you get right to the point we created our investment calculator. Please note we are unable to provide investment advice but happy to discuss products and their features allowing you to make the final decision.

Do I pay Capital Gains Tax (CGT) On Silver?

An investor will only pay CGT if they gain over £3,000 in profit during a given financial year (accurate as of Nov 2020) across all assets liable for CGT, not just precious metals.

This threshold is assessed each year but can be avoided if the profit is realised on certain bullion products such as Silver Britannias, as these are pound sterling legal tender coins. The current CGT tax allowance can be found on the HMRC site, whilst our CGT exempt silver coins page offers single coins to monster boxes, international storage and recent releases.

Do I Pay VAT on Silver?

As a United Kingdom resident, you will be charged VAT at the standard rate, which is currently 20% if you take delivery of silver in the UK. If you are outside the UK and ask us to export the items for you there is no VAT applicable, and you could even reclaim any VAT paid if you choose to export yourself.

Do I Pay VAT on Silver?

If you buy new silver VAT at the standard rate is applied to the full value of the goods, whereas if you buy second hand silver sold on the special scheme you will pay standard rate VAT on the dealers margin. Please note not all second hand goods are sold on the special scheme.

You can take advantage of VAT-free silver and platinum stored in bonded warehouses - these products are intended for investors looking for long-term bullion storage overseas. Please note these products are intended to be sold as 'storage only' items and are not a cost-effective option should you ever wish to take delivery. Costs to take delivery or collect will include handling fees, custom clearance charges and even tax liabilities. If you choose to simply sell back to Chards you never need to pay the VAT.

If you are based outside the UK and wish to purchase silver, palladium or platinum, it will be treated as a zero-rated sale. Please contact us on 01253 343081 and we will place your order without VAT. It is advisable to consult your relevant government authority for information on importing precious metals and any duties/taxes which may be payable.

You may also be able to reclaim the VAT if the precious metals are being purchased on behalf of a VAT registered business. If VAT is reclaimed in this fashion, then you will need to find a buyer willing to pay VAT on the precious metals if you decide to sell later on. Consult the government's Reclaiming VAT webpage for more information.

What is the Special Scheme?

The special scheme applies to second hand or pre-owned silver, platinum and palladium coins and bars and non-investment gold.

The scheme allows dealers to apply standard rate VAT to profit margins instead of the overall selling price which results in a lower overall cost and a better deal for investors.

What is Grade C?

Grade C is applied to an item that is too good for scrap but not good enough to sell as bullion.

We would recommend using Grade C items in jewelry. Although they may have lower premiums over spot than their bullion counterparts, we will most likely offer a lower buy back price. We will always ensure that our grade c products do not include any underweight, holed, or fake coins or bars.

What Are “Minty” Products?

As the name suggests, our “Minty” range of coins are in fantastic condition, in many cases the coins are still in their original packaging, and have usually been issued within recent years.

This often gives private investors the opportunity to potentially purchase high quality bullion at a lower premium than the most recent year.

Do You Sell Investment Silver?

Yes! At Chards we offer a wide range of investment options that are regularly compared against other leading dealers to ensure we consistently offer the best value on silver bullion coins and bars. For those who are unsure what to invest in, our investment calculator allows new and seasoned investors to choose from the best value products based on their budget! From our low premium "minty" and "grade c" lines to our digital gold and silver, Chards offers a diverse range of investment products within precious metals.

Cheapest Place to Buy Silver Online

Chards Coin and Bullion Dealer of course! We compare prices daily on many of our top selling products to ensure that we remain competitive where we can by offering the lowest premium products to you.

Our pricing on bullion products is transparent with any premium and surcharges published live so you can easily compare us against other deals or compare different weights of products without carrying out your own calculations. We don’t hide added VAT costs, hidden “free postage” fees or deploy any bait and switch techniques to up sell higher premium products. We want you to walk away with a great experience to keep coming back time and again. We have dedicated pages for our price comparisons, as well as across our product pages under the "UK Dealer Comparison" tab.

What Is "Orderable" Bullion?

As we constantly buy and sell bullion from the secondary market, we may experience times where demand is higher than supply. When this happens, bullion items go to a 'orderable' status. The delay can range from days through to weeks or even months. These products are only recommended to customers who are comfortable to wait and where this is not the case we strongly recommend buying the latest year coin at a slightly higher premium.

When orders are placed for awaiting stock products, we will provide you with a fortnightly update on the progress of your order. You can consider the interim period as 'free storage' as you can sell your items at any point back to Chards without physically taking receipt. This means customers who buy from Chards can take advantage of any swings in the metal price all the way up to the point of delivery. We honour the price at the time you place your order so even if silver was to skyrocket you would not pay any more when they arrive into stock and if you wish to switch products to in-stock alternatives we also use the original gold price on the order. Should you wish to read more please visit our page on 'orderable' bullion.

How Much Silver Should I Buy?

The answer depends on your budget, tastes, appetite for risk and investment strategy.

As with any investment the widely held ideal is to buy low and sell high, in turn making yourself a nice profit. Depending on your ability to interpret market conditions and your appetite for risk you may wish to take the plunge investing all your money at once however, you sense risk you may wish to dollar cost average across a wider time period.

We only recommend investing amounts that you feel comfortable with and to help you get right to the point we created our investment calculator. Please note we are unable to provide investment advice but happy to discuss products and their features allowing you to make the final decision.

What Is a Digital Metal Account?

Many investors do not want to purchase physical coins and bars due to the lack of storage to store the precious metal. At Chards we use two types of metal accounts with Digital unallocated metal accounts and Digital allocated. These metal Digital Metal accounts allow users to purchase silver and gold the digital way meaning they will have many benefits as seen below.

- Pre-funding a larger future deal by making multiple smaller payments which is often referred to as "dollar-cost averaging*

- Treating the accounts as a savings account by making frequent deposits from surplus wages, savings, or investments.

- Gaining exposure to the metal market without incurring the costs associated with the purchase of a specific item, postage, or storage. We will always recommend transacting into physical bullion as we believe this to be the superior choice when investing in metals.

- Very low premiums - our digital gold and silver come in at a 1% buy premium and you can sell back to us at 100% of spot making the buy-sell spread a narrow 1%. For vaulted gold and silver, you pay the live premium on the day with 1 ounce gold coins prices starting from 1.8%- and 1 ounce silver coins starting from 20%.

- We manage our whole inventory and storage facilities which are insured by Lloyds of London. There are no further third-party risks, and the arrangement is a simple two-party agreement between you and a bullion dealer with over 55 years’ experience.

- Easily convertible to physical metals which can then be delivered to your door, fully insured.

- An easy-to-use platform for digitally-savvy investors.

How to clean silver metal coins

The best way to clean silver coins is in warm water and use a standard soap that can be used to rub and soak the coin for around 10 minutes. You must avoid using other household items such as a chemicals or brushes as this can make the coins lose value.

More Helpful Pages

Delivery Of Your Bullion By Post FAQ

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2025. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.