Buying and Selling Rare Coins At Auction

Synopsis

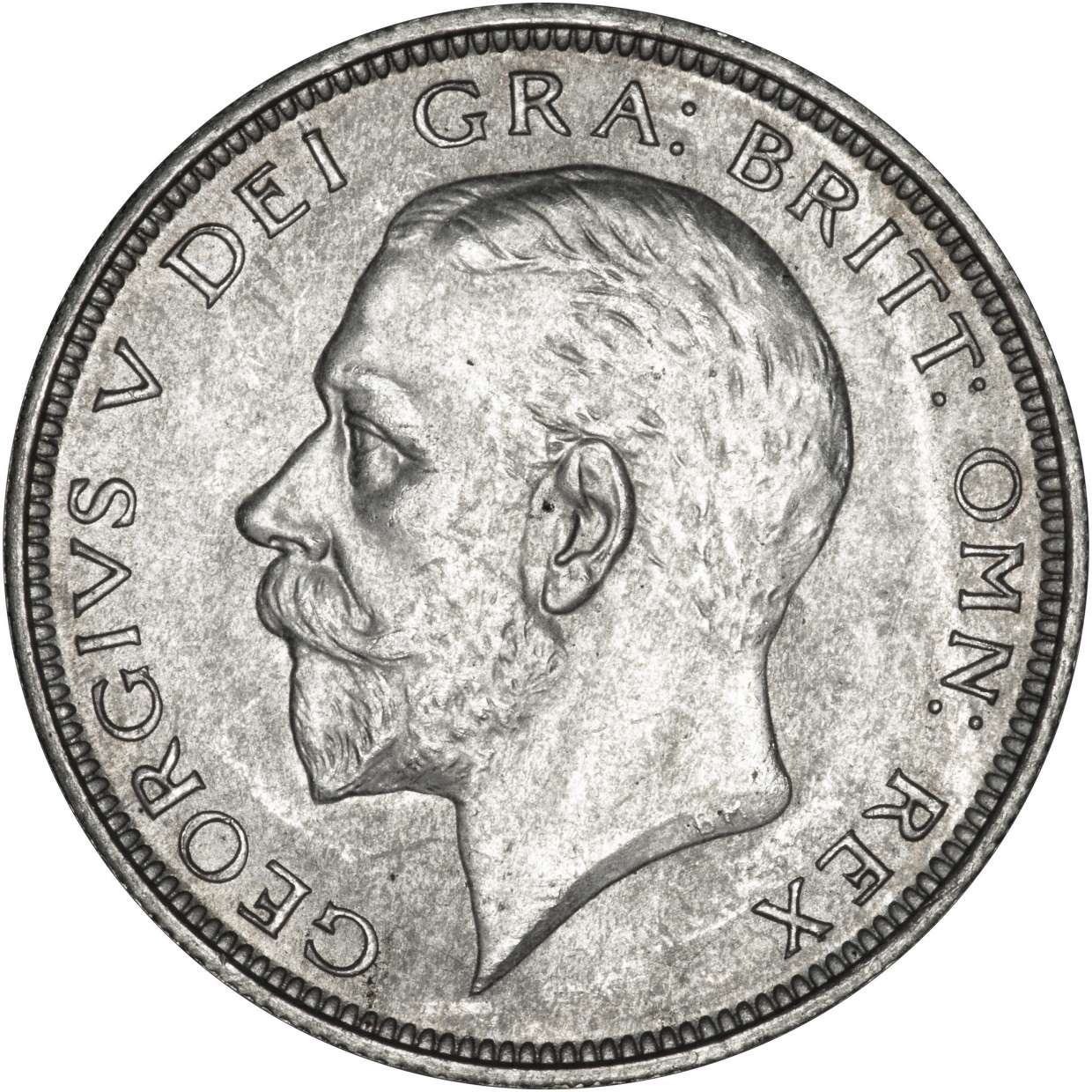

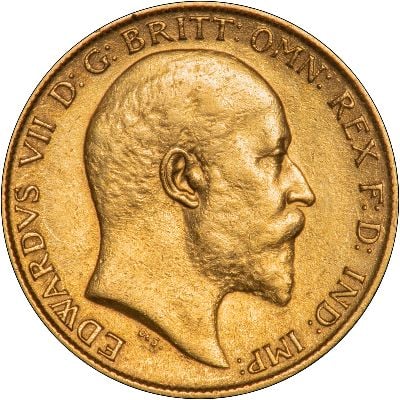

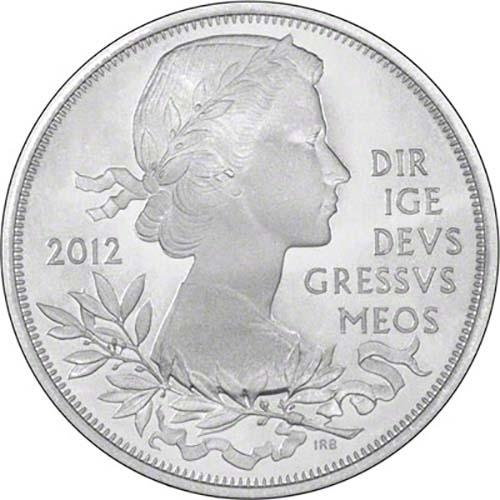

Many collectors of old coins swear by selling their bullion and rare coinage at auction, whilst others use highstreet auction houses and their online counterparts to purchase their haul in an effort to avoid high premiums, but are these truly the best ways to buy and sell collectable coins?

Selling Rare Coins At Auction

For a number of years, the world's biggest auction houses, Sotheby, Christies, Philips (Glendinings), and a few others have held large auctions of important coin collections. These prestigious auction houses can provide, or used to provide, a useful market place for high value coins, large hoards, and larger collections. In recent years, the number of coin auctions held by the larger auctioneers appears to have declined. Smaller more specialised auction houses have often taken their place, but they too appear to struggle for business.

One major drawback to selling in some of these larger auctions was the delay. It might be necessary to wait several months for the "right" auction, then it would take time to catalogue, after which there would be a wait to get paid. It might take 3 to 6 months from deciding to sell to getting paid. At any auction houses, but particularly at the larger ones, it was quite possible for very high grade coins to be handled carelessly at public or trade viewings. This could result in lower prices obtained, or even unsold coins being returned to their owner in poorer condition.

The larger auction houses charge for photographs in their catalogues, and coins consigned to them are not automatically covered by insurance. This could add extra charges to the costs of selling.

Buyers Premium In Auction

There was major publicity about a decade back when the larger auction houses introduced buyer's premiums, i.e. a charge to the buyer over and above the hammer price. This was in addition to the commission charged to the seller. For years the larger auction houses had been charging between 10% and 15% commission to sellers, but vendors could shop around and haggle over commissions, especially when large collections were involved. Also many auction houses share their commissions with agents who introduce sellers. the buyers premium was a simple but clever and very effective way to grab a bigger percentage of the sale price. Although a number of major antique dealers staged buyers strikes, these quickly faded out. Buyers at an auction are not in any position to haggle about buying commissions, whereas vendors are.

The result of these double commissions has been to create a significant jump in the profits and margins of the large auction houses. Smaller auction houses have followed their lead. Most auctioneers now charge between 10% and 15% commission to both buyers and sellers, typically making about 25% total commission. In the UK, and probably most other countries, VAT cannot be reclaimed on buyers premiums, many vendors cannot reclaim VAT, so the cost of selling by auction is now close to 30% of the hammer price. Many dealers will work for less, depending on the type of item.

Seling Coins With Online Auctions

Internet auctions such as Ebay have made significant changes in the international marketing of many different types of item, but particularly to antiques and collectables including coins. They have made it easier for buyers and sellers to meet up to buy and sell, particularly for specialised items, and second-hand goods, the type of article which the mainstream High Street retailer is not good at. Ebay have established a de facto monopoly within the space of a few years, and now has over 90% of the internet auction market for coins. Any such monopoly should be a cause for concern by its users.

Buying And Selling Coins On eBay

Ebay charge listing fees, enhancement fees, and final value fees. This can make it quite difficult to work out exactly what the total cost will be to sell any particular item. Their fees system is a somewhat like Gordon Brown's tax policy with its use of "stealth tax", Ebay use "stealth fees". Listing fees start at 15 pence in the UK for goods with a starting price under £1, but rise to about £2 for items with a starting price over £100, unless you use a "Buy It Now" price, when the listing fee is based on this price instead of the starting price. You can also choose to use a "Reserve Price", but this costs up to £100, so is best avoided, as it appears to have no real advantage to the seller compared with the "Starting Price" fee.

Enhancement fees include home page featured, featured plus, highlight, item subtitle, bold, gallery, featured gallery, scheduled listings, list in 2 categories, image hosting, and probably a few more we don't know of. Final value fees are mainly commission based, starting at 5.5% for the first £29.99, 3.5% from £30 to £599.99, and 1.75% on the balance.There are also fees payable for using other services such as "Selling Manager Pro", or some of their listing tools, although some tools are provided free.

Cars and Real Estate (Property) have different scales of fees starting at £6 and £35 respectively.

Although just about anybody can register to buy on Ebay, you have to provide credit card, debit card, direct debit, or similar details, which need to be approved before you can register to sell on Ebay. This is basically so that Ebay can ensure they get their fees, rather than to vet sellers for the protection of buyers.

Finding Gold Bullion Coins Online

Providing you go to a specialised gold coin dealer, you can buy for less and sell for more using traditional dealers, and get paid more quickly than by using auctions. Many bullion dealers work on as little as 1% or 2% "commission" when buying or selling, depending on volume. A margin of 5% or 10% would be quite high for a bullion coin dealer. This compares very favourably with all auction houses, even electronic ones such as Ebay.

To sell a krugerrand on Ebay costs about £9 using a £0.99 starting price, or £10.50 using a realistic starting price, assuming you don't pay extra for bold face, a coloured stripe, or any of the other enhanced (more expensive) options. In addition, you will have to do a certain amount of work to scan an image or take a photograph, and deal with enquiries from potential buyers who often expect you to accept payment by Paypal which will cost about 5% extra.

Where Should I sell My Gold Bullion?

Some sellers seem to think that all dealers pay low prices for their stock. While there are many small dealers who undoubtedly make most of their money by enjoying lower premiums, most dealers pay very competitive prices. We, for example, are happy to buy most gold coins in any quantity, often at 1% or 2% discount. Considering this is less than eBay's starting commissions, we think this is a good deal for most people. You can also deliver them in person to our premises. Naturally, we are not the only dealers around, it's worth checking round your local area first, which can save you postage costs. Bear in mind though that you may need to contact a specialist dealer, and we have only about two major competitors in the UK. If you try to sell to a jeweller, they may acid-test and damage your coins without asking your permission, because they are unlikely to know the gold content, or to have specific coin (numismatic) expertise. They will usually expect to buy your coins at 10% discount, or even worse. Coin dealers may have more expertise, but many coin dealers prefer to avoid gold bullion because of the low margins, and the necessity to lay out large amounts of cash, and other cost such as insurance cover and risks while the coins are in their possession. Some dealers prefer to stick to Roman coins or some such specialist area.

Related Blog Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.