Deutsche Bank’s Challenges and Risk of Collapse

Synopsis

The Deutsche bank has faced numerous challenges recently that have led to concerns about its stability and possible collapse. Reports indicate a surge in demand for insurance against Deutsche Bank's potential collapse, which has made many investors apprehensive that it could be the next to fail. This is especially concerning because the bank's size and interconnectedness with other financial institutions could trigger a domino effect in the event of its collapse.

Key Takeaways

- Deutsche Bank, with assets of over €1.4 trillion, is the 22nd largest bank in the world.

- The bank's recent challenges include its involvement in numerous scandals, which have damaged its reputation and eroded investor confidence.

- Investors are concerned about the potential for Deutsche Bank's collapse and the wider implications for the financial industry, including the risk of a domino effect.

- Regulators and policymakers are taking steps to address the potential risks posed by Deutsche Bank's situation, including increased oversight and regulation of the banking industry and specific measures to address the bank's vulnerabilities.

- Many investors are turning to alternative investments, such as gold and silver, as a way of protecting their portfolios in the face of uncertainty in the economy.

- The fate of Deutsche Bank and the wider financial industry will depend on a range of factors, including regulatory and policy responses, the strength of the global economy, and the ability of banks and financial institutions to adapt to a rapidly changing business landscape.

Deutsche Bank's Recent Challenges

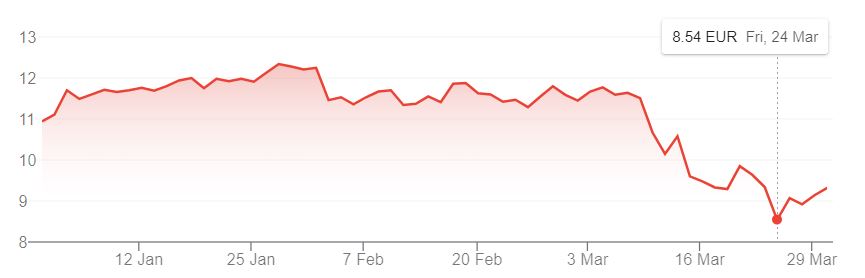

Deutsche Bank's stock price dropped by around 30% in less than two months, and while it has rebounded slightly in recent weeks, many investors remain sceptical about its future prospects. One of the biggest challenges facing Deutsche Bank is its involvement in numerous scandals over the past few years. One of the biggest of these scandals was its ties with Jeffery Epstein, the convicted sex offender.

Deutsche Bank AG Stock Drop

Deutsche Bank was found to have facilitated millions of dollars of suspicious transactions for Epstein, despite being aware of his criminal history and playing a significant role in his financial dealings. As a result, the New York Department of Financial Services fined Deutsche Bank €150 million, and the bank was also fined for failing to detect money laundering from two European banks it was working closely with. Deutsche Bank has received repeated warnings from the Federal Reserve about its procedures for preventing money laundering in the United States.

Deutsche Bank's involvement in these scandals has damaged its reputation and eroded investor confidence in the bank's ability to manage risk effectively. The bank has stated that it is taking steps to address these issues, but it is unclear whether these efforts will be enough to restore investor confidence in the bank's future prospects.

Investor Concerns and the Potential for a Domino Effect

Investors are rightly concerned about the potential for Deutsche Bank's collapse and the wider implications for the financial industry. The bank's size and interconnectedness with other financial institutions make it a systemically important bank, the failure of which could have far-reaching consequences.

One of the biggest concerns is the potential for a domino effect, where the collapse of Deutsche Bank could lead to a cascade of failures in other financial institutions. This is because Deutsche Bank is interconnected with other banks and financial institutions through complex financial instruments and transactions.

If Deutsche Bank were to fail, it could trigger a liquidity crisis in the banking system, where other financial institutions would struggle to access the funds they need to meet their obligations. This could lead to a broader credit crunch and a contraction in the economy, as businesses and individuals struggle to access the credit they need to operate.

There are also concerns about the impact of Deutsche Bank's failure on the wider financial system. Regulators and policymakers are keeping a close eye on the situation, but there is a real risk that the failure of Deutsche Bank could trigger a wider financial crisis.

What Is the Regulatory and Policy Response?

Regulators and policymakers are aware of the potential risks posed by Deutsche Bank's situation and are taking steps to prevent a potential worldwide crisis. One of the key responses has been to increase oversight and regulation of the banking industry. Since the 2008 financial crisis, regulators have implemented a range of measures to increase the resilience of the banking system, including higher capital requirements, stress testing, and improved risk management practices.

The ECB has also imposed a number of restrictions on the bank, including limiting its ability to pay dividends or bonuses to staff and requiring it to hold more capital to protect against potential losses. These measures are designed to strengthen the bank's financial position and reduce the risk of its failure.

In addition to regulatory and policy responses, there have also been calls for structural reform of the banking industry. Some analysts argue that the current system, with its complex financial instruments and interconnectedness, is inherently unstable and that a more simplified and transparent banking system is needed to reduce the risk of future crises.

Growing Distrust of Large Banks and the Rise of Precious Metals

The recent challenges facing Deutsche Bank, along with other high-profile banking scandals and crises, have contributed to a growing distrust of large banks and financial institutions. Many investors are increasingly turning to alternative investments, such as gold and silver, as a way of protecting their portfolios in the face of uncertainty in the economy.

One of the key advantages of investing in gold and silver is that they are tangible assets that can be held physically, rather than relying on trust in financial institutions. Unlike stocks or bonds, which are subject to market volatility and the risk of collapse, gold and silver have been valued across the world for thousands of years and are seen as a reliable store of value.

The rise of digital currencies, such as Bitcoin and other cryptocurrencies, has also contributed to the trend towards alternative investments. These currencies are designed to circumvent traditional banking systems and offer a decentralized, peer-to-peer alternative to traditional financial transactions.

While the rise of alternative investments like gold, silver, and cryptocurrencies may be a response to the challenges facing the banking industry, it also reflects a broader trend towards a more decentralised, digital economy. As technology continues to transform the way we do business, it is likely that we will see further disruption in the financial industry, with new players emerging and traditional institutions struggling to adapt.

The Current Risks in Banking

Deutsche Bank's recent challenges are a reminder of the systemic risks inherent in the banking industry and the potential for a single failure to trigger a wider crisis. While regulators and policymakers are taking steps to address these risks, there is no guarantee that they will be enough to prevent future crises.

Ultimately, the fate of Deutsche Bank and the wider financial industry will depend on a range of factors, including regulatory and policy responses, the strength of the global economy, and the ability of banks and financial institutions to adapt to a rapidly changing business landscape. As investors and consumers, it is up to us to stay informed and make informed decisions about how to protect our assets in the face of uncertainty.

.jpg)

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.