Russian Rouble Continues to Decline in 2023

Synopsis

The Russian rouble fell to its lowest value for the year in April 2023 due to factors including lower oil prices and economic sanctions. This highlights the importance of asset diversification, and gold is a vital asset that can help protect wealth during times of economic uncertainty.

Key Takeaways

- The Russian rouble has fallen to its lowest value in a year due to several factors, including lower oil prices and economic sanctions.

- Gold is a safe-haven asset that can help protect wealth during times of economic uncertainty.

- Gold is particularly important for residents of countries with aggressive martial policies, corrupt and inefficient governments, and other challenging conditions.

- Central banks, investors, and individuals all recognize the value of gold as an asset and store of value.

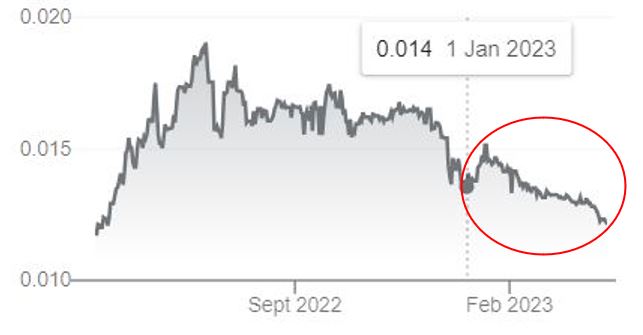

Russian Rouble to USD in 2023

The recent decline of the Russian rouble to its lowest value in a year has brought attention to the significance of understanding the impact of currency fluctuations on asset value. On Friday 7th April 2023, the Moscow Stock Exchange (MOEX) witnessed a decline in the currency value, with the exchange rate reaching 82 roubles against the US dollar. This was a level that had not been observed since the time of Russia's invasion of Ukraine. This fall is attributed to various factors, including lower oil prices in March that have reduced Russian revenue and the sale of Western businesses in Russia following the invasion. These factors, coupled with massive economic sanctions since Russia began its offensive in Ukraine in February 2022, have led to the rouble's decline.

Russian Rouble to US Dollar Exchange Rate In 2023

The Resilience of the Russian Economy

Although the Russian President, Vladimir Putin, had previously claimed that the economy remained strong despite the economic sanctions, he has recently admitted that the penalties could have negative implications for Russia. Anton Siluanov, the Finance Minister of Russia, has attributed the recent decline to changes in the country's imports and exports, according to his statement.

In addition, he mentioned that the foreign economic situation is subject to fluctuations, which in turn can impact the exchange rate. However, he anticipates that the Russian rouble will appreciate due to the sustained global demand for Russian energy sales, despite the current situation, as per his projections. The resilience of the Russian economy, despite the sanctions, is noteworthy. The country's shock absorption capacity, the role of energy exports in sustaining the economy, and the ability of local entrepreneurs to fill the gaps left by Western businesses are all contributing factors.

Why Should You Own Gold in Time of Economic Crises?

In countries with aggressive martial policies, corrupt and inefficient governments, and other challenging conditions, gold is particularly significant. It can help protect one's wealth during times of crisis as it is a tangible asset that can be easily transported across borders. Gold can also help circumvent government controls on currency exchange and capital outflows. It is a safe and secure way to protect one's wealth from confiscation and expropriation.

Furthermore, gold is a store of value that can be passed down from one generation to the next. It can help preserve wealth and protect it from being eroded by inflation. Gold coins and bullion can be stored in secure vaults or personal safes, ensuring that the assets remain safe for future generations. Asset diversification is essential for everyone, especially for those living in countries with unstable political and economic conditions. Gold is an essential component of any diversified investment portfolio and can help mitigate the risks associated with other investments. Its value is stable and not subject to the same volatility as other investments like stocks or bonds.

The Importance of Gold as a Safe-Haven Asset

In times of economic uncertainty, investors and individuals may be looking for safe and stable assets to preserve their wealth. In this regard, the importance of a significant and secure asset like gold cannot be overstated. Historically, gold has been considered a safe-haven asset, and its value has remained stable, making it an excellent hedge against inflation and currency fluctuations. Its value is not affected by the stock market or interest rates, making it a valuable addition to any investment strategy. Additionally, gold prices often rise in times of economic crisis, making it a safer option than other assets.

Related Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2025. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.