Fed To Hold Interest Rates at 22 Year High

Synopsis

The Federal Reserve has maintained interest rates at their highest in 22 years, despite a recent surge in inflation. Discover the rationale behind this decision, how it impacts the cost of living in the US, and the implications for the global economy. Stay informed with our insightful analysis.

Key Takeaways

- The Fed has maintained interest rates at 5.5% the highest level in 22 years

- This decision surprised some economists due to the rise in inflation, from 2.97% in June 2023 to 3.7% in August 2023.

- In September 2023, the US interest rate did not increase for the first time since March 2022.

Fed Holds Interest Rates at 5.5%

The Fed has decided to maintain the current interest rates, keeping them at their highest level in 22 years.

This decision has come as a surprise to some economists, given that inflation in June 2023 stood at 2.97%, and within just two months, it has risen by 0.73%, reaching 3.7% in August 2023. One of the reasons why the Federal Open Market Committee (FOMC) may not have increased interest rates is to provide the central bank with more time to observe whether inflation continues on an upward trajectory, as the objective is for US inflation to decrease to the 2% inflation target.

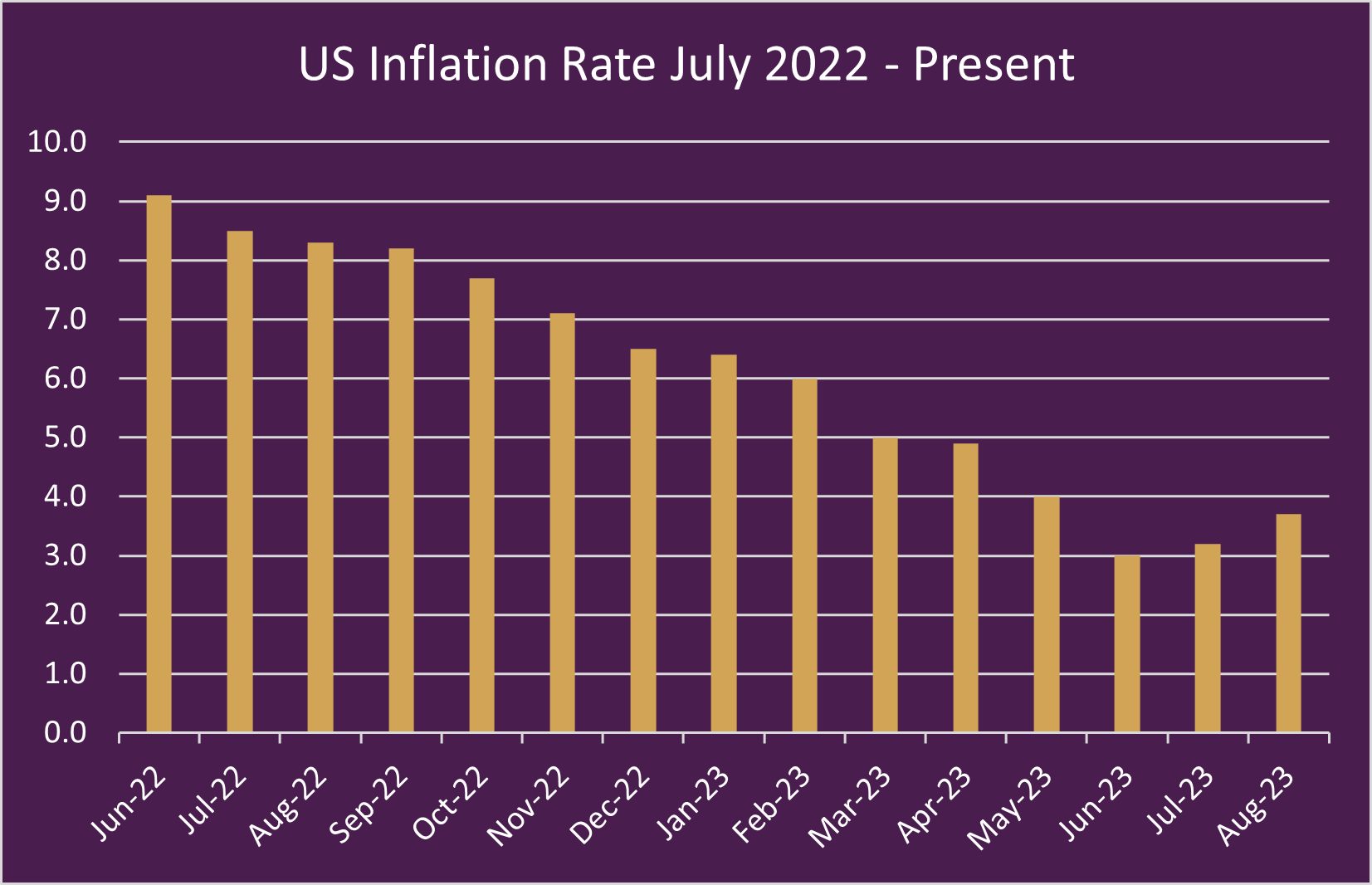

Figure 1 - Monthly Inflation rate in the United States from June 2022 to August 2023

As depicted in the graph above, the United States has experienced a year-long decline in interest rates, starting from June 2022 (9.06%) and extending to June 2023 (2.97%), followed by an increase over the subsequent two months. Based on US inflation statistics, Americans are hopeful that inflation will start to recede next month to prevent further inflationary pressures in the United States.

First Non-Increase Since March 2022

In September 2023, the interest rate did not increase, marking the first instance in which US interest rates had not been raised since March 2022.

| FOMC Meeting Date | Federal Funds Rate | Rate Change (bps) |

| Mar-22 | 0.25 to 0.50% | + 0.25 |

| May-22 | 0.75 to 1.00% | + 0.50 |

| Jun-22 | 1.50 to 1.75% | + 0.75 |

| Jul-22 | 2.25 to 2.50% | + 0.75 |

| Sep-22 | 3.00 to 3.25% | + 0.75 |

| Nov-22 | 3.75 to 4.00% | + 0.75 |

| Dec-22 | 4.25 to 4.50% | + 0.50 |

| Feb-23 | 4.50 to 4.75% | + 0.25 |

| Mar-23 | 4.75 to 5.00% | + 0.25 |

| May-23 | 5.00 to 5.25% | + 0.25 |

| Jul-23 | 5.25 to 5.50% | + 0.25 |

| Sep-23 | 5.50% to 5.50% | - |

Figure 2 - Fed Rates Hikes 2022-23: Battle Against Inflation

What Impact Has the Increase in US Inflation Had on the US?

Cost of living in the United States - Distribution of Expenses

This data was obtained through Numbeo, an online database founded in Serbia. The database relies on cost of living metrics such as consumer prices, real property prices, and quality of life metrics. The information provided is valid as of July 2023 in the United States.

- Rent Per Month - 36.7%

- Markets - 28.8%

- Restaurants - 13.5%

- Transportation - 7.7%

- Monthly Utilities - 7.5%

- Sports And Leisure - 4.1%

- Clothing And Shoes - 1.7%

Europe Prepares for Further Increases in Interest Rates

On Thursday, September 14, 2023, in response to surging inflation, the European Central Bank (ECB) raised interest rates for the 10th consecutive time. The ECB increased the deposit facility rate from 3.75% to 4%, the main refinancing operations rate from 4.25% to 4.5%, and the marginal lending facility rate from 4.5% to 4.75%. This decision, which led to the highest rates since the euro's inception, had an impact on the Euro's value, causing it to hit a three-month low against the dollar.

The Bank of England (BOE) have their meeting on Thursday 21 September 2023. Economists predict that the BOE is likely to raise interest rates, as they are still far from achieving the 2% target set by their monetary policy. On Wednesday, September 20, 2023, the Consumer Price Inflation (CPI) in the United Kingdom declined from 6.8% to 6.7%, while the Consumer Prices Index (CPIH) also experienced a similar drop, decreasing from 6.4% to 6.3%, according to the August 2023 data.

Related Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.