UK Economy Contracts by 0.1% in May - While GBP Reaches 15 Month High

Synopsis

Discover the latest UK Economy Report by the Office for National Statistics: a 0.1% dip in May 2023, influenced by King Charles' coronation and an additional bank holiday. Uncover more insights on inflation, interest rates, and the soaring GBP in this intriguing report. Let's delve deeper into the details!

Key Takeaways

- In May 2023, the Office for National Statistics reported a 0.1% shrinkage in the UK economy, following April's 0.2% growth.

- A notable fact is that the UK economy in May 2023 is only 0.2% higher than pre-COVID-19 levels, with King Charles' coronation being a significant reason for the decline.

- Based on a steady 8.7% inflation rate in May 2023, the Bank of England raised interest rates to 5% on 22nd June 2023.

- The GBP hit a 15-month high against the USD due to expectations of interest rate hikes in the UK and a decline in US inflation.

Office for National Statistics UK Economy May Report

The UK economy has shrank by 0.1 percent, according to the latest report from the Office for National Statistics (ONS). The ONS released its monthly estimate of GDP (Gross Domestic Product), specifically for the UK May 2023 bulletin. The report indicates that the real GDP for the month of May 2023 experienced a decline of 0.1 percent, following a growth of 0.2 percent in April 2023. (source)

This reveals several intriguing facts, notably that the UK economy in May 2023 is only 0.2% higher than the pre-COVID-19 levels observed. The particular reason behind the decline this month is attributed to King Charles' coronation, which took place on Saturday, 6th May 2023. This event resulted in the UK enjoying an additional bank holiday on the subsequent Monday, 8th May 2023. Many economists believe that this is one of the major reasons for the drop-off in the UK economy. Additionally, it is worth noting that the UK has experienced no GDP growth for the past three months.

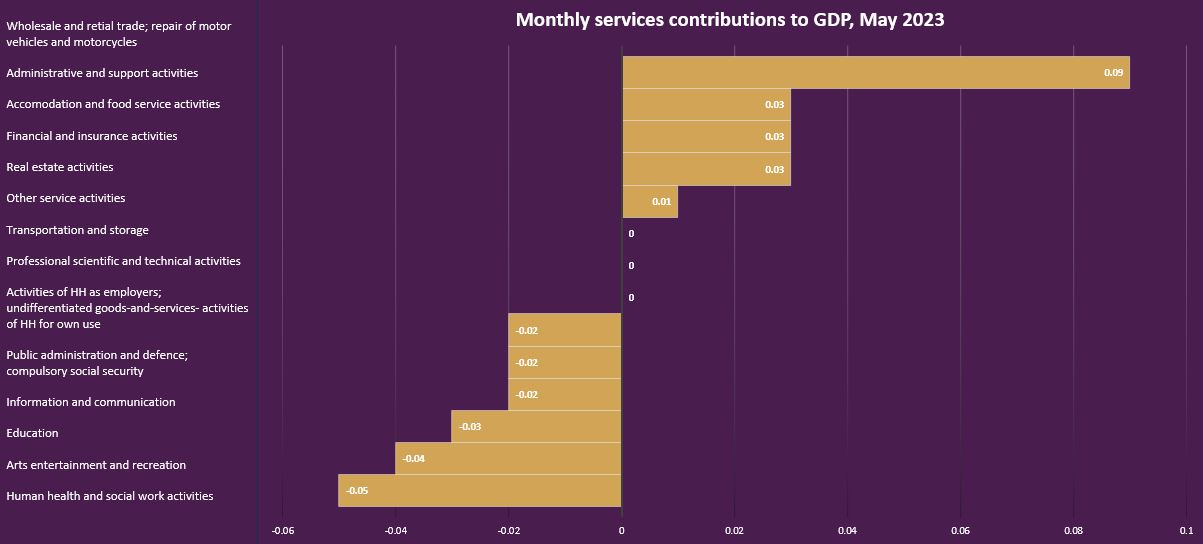

In May 2023, both production and construction experienced declines, with production down by 0.6% and construction down by 0.2%; Figure 1 provides a list of the monthly services that contributed to the GDP of May 2023.

Source: GDP monthly estimate from the Office for National Statistics

What is Economic Growth?

Economic growth is highly valued due to its positive impacts. It signifies a thriving environment with more job opportunities, profitable businesses, and higher rewards for employees and shareholders. Such growth also generates increased tax revenue for the government, enabling choices in public spending. These funds can be utilised to enhance welfare programs, improve public services, boost government employees' wages, or implement tax reductions.

Even during economic contractions, governments still possess the discretion to allocate resources for public expenditures. Economic growth encompasses the expansion of overall output, productivity, job creation, higher incomes, and improved living standards for individuals in society.

King Charles III Coronation

On the 6th of May, 2023, more than 20 million people in the United Kingdom, and millions more across the globe, witnessed the coronation of King Charles III and his wife on national television. Whilst this may seem impressive, during Queen Elizabeth II's coronation in June 1953, around 27 million people (with the UK population being 36 million at the time) observed the event.

This significant figure represents slightly less than 73% of the UK population in 1953, whereas in 2023, approximately just under 30% of the people in the UK watched. It is noteworthy that during Queen Elizabeth II's coronation, the televised event served as the first exposure to television for many individuals in the UK. In contrast, today, both in the UK and worldwide, media has expanded significantly and continues to flourish in 2023.

King Charles III Coronation Coins

In celebration of this momentous occasion, The Royal Mint has released coronation coins of King Charles III in both gold and silver.

UK's Current Inflation and BOE Interest Rate

On 22nd June, 2023, the Bank of England (BOE) increased interest rates by another 0.5 percentage points, lifting them to 5%. The BOE decision to raise interest rates to 5% is based on the May 2023 inflation rate, which remained unchanged (8.7%) compared to April 2023. This decision came after a percentage point increase in May 2023, which saw interest rates go from 4.25% to 4.5%.

In May, the inflation rate in the UK remained at 8.7%, the same as the rate in April. However, in April 2023, the nation experienced the most significant decline in inflation since the crisis started, with the annual rate dropping to 8.7% from an astonishing 10.1%. This outcome was unexpected by expert economists, who had anticipated a drop in inflation to 8.4% by this stage.

As of June 2023, consumer price inflation in the United Kingdom has dropped to 7.9 percent, which marks the lowest level since March 2022.

GBP Hits 15-month high

The British pound reached $1.306 against the US dollar, marking its highest level since April 2022 and representing a 0.5% increase. Throughout this year, the pound has experienced an impressive appreciation of nearly 8% against the dollar, largely influenced by expectations of interest rate hikes to curb inflation.

As of July 12, 2023, the pound surged to $1.30 for the first time in 15 months following an unexpectedly significant decline in US inflation. Consequently, there is growing optimism that the US Federal Reserve may soon conclude its series of interest rate hikes.

As per Victoria Scholar, the Head of Investment at interactive investor, the following statement is made:

"The pound hit a 15-month high this week against the US dollar after US CPI fell to 3% in May while the UK still struggles with sky-high price pressures with growing potential interest rate differentials boosting the allure of sterling. GBPUSD is in the green this morning, trading above the key $1.30 handle and the pound is also higher against the euro.” (Source)

Related Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.