Eurozone Interest Rates Up to 3.5% Reaching Highest Level in 22 Years!

Synopsis

Discover the ECB's bold move as interest rates reach the highest level in over two decades. With a 0.25% increase, the key deposit rate surged to 3.5%. ECB predicts more hikes, and revised inflation forecasts reveal a persistent inflation battle. Witness market reactions and external factors shaping the Eurozone's economic trajectory. Stay informed to make informed investment decisions.

Key Takeaways

- The ECB raised interest rates to their highest level since 2001

- The key deposit rate reached a 22-year high of 3.5%,

- Revised inflation forecasts indicate expectations of 5.4% inflation in 2023

- Euro surging against major currencies and yields on two-year debt experiencing significant spikes.

- Gold investment can serve as a hedge against inflation, as its price tends to rise during periods of increasing prices.

Interest Rates Reach Highest Level in Over Two Decades

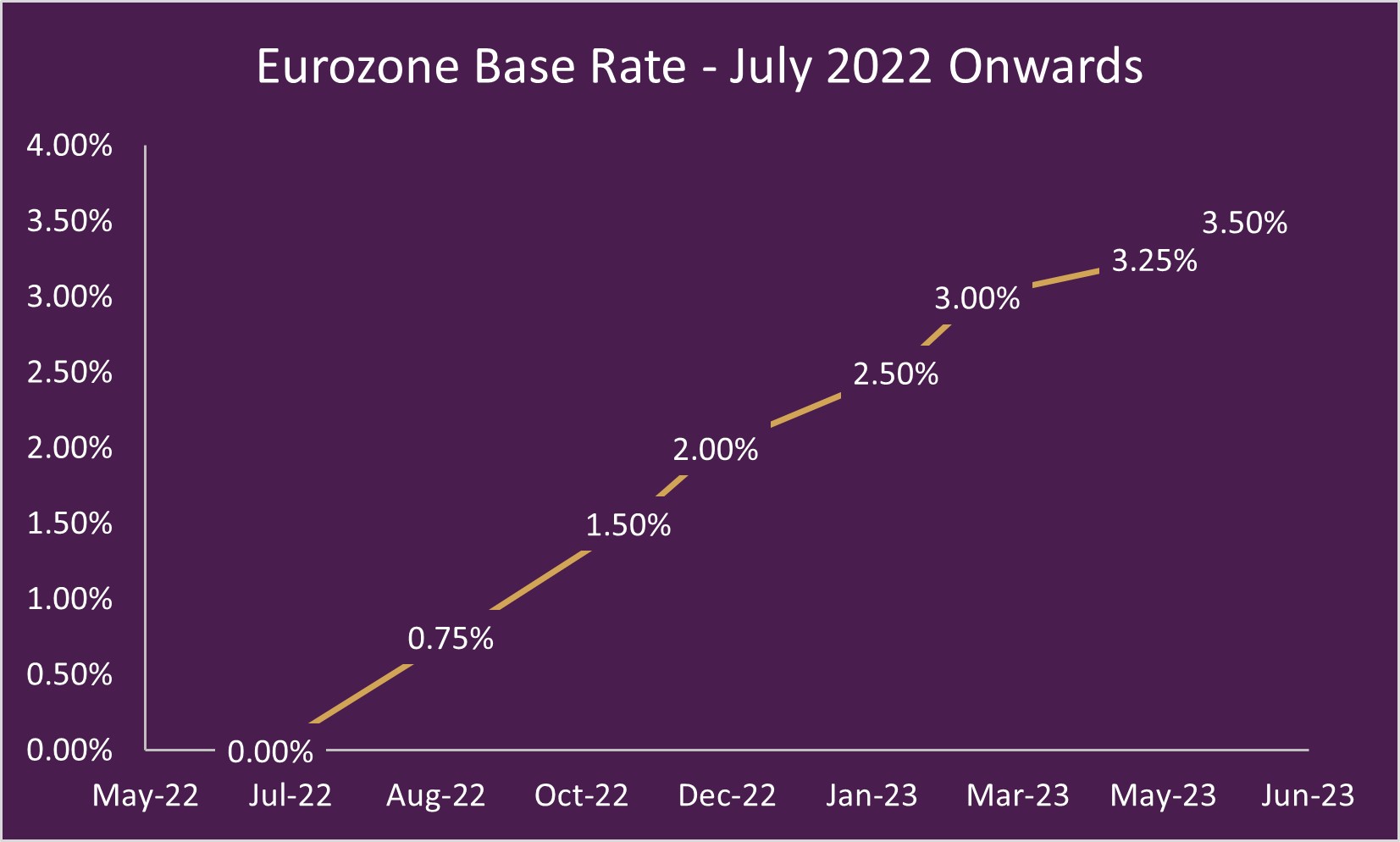

The European Central Bank (ECB) recently made a significant and anticipated decision to raise interest rates to their highest level since 2001. In an effort to address inflationary pressures, the ECB implemented a 0.25 percentage point increase across all three of its key interest rates. This decision propelled the key deposit rate to a 22-year high of 3.5%, aligning with market expectations. By taking this bold step, the ECB has demonstrated its commitment to addressing inflation within the Eurozone.

This move, aimed at combating stubborn inflation, has resulted in increased borrowing costs. ECB President Christine Lagarde has expressed a strong likelihood of additional rate hikes at the upcoming meeting in July. Emphasising the urgency of tackling inflation, Lagarde indicated that the deposit rate may surpass the previous record set in 2000 next month, with further increases anticipated during the summer.

Eurozone Inflation Forecasts in the Upcoming Years

The ECB unveiled revised inflation forecasts that indicate an upgrade in their expectations for the next three years. Projections now suggest that inflation across the Eurozone will reach 5.4% in 2023, 3% in 2024, and 2.2% in 2025. Lagarde emphasized the persistence of elevated inflation, warning that it is expected to endure throughout 2024. These revised forecasts underscore the ECB's commitment to tackling inflationary pressures within the region.

How Has the Bond Market Responded?

The bond markets responded dramatically to the ECB's revised inflation forecasts. The value of the euro surged against both the dollar and pound, indicating market confidence in the ECB's decision to raise interest rates. Additionally, yields on two-year debt experienced significant spikes. Short-term bonds are particularly sensitive to anticipated movements in central bank interest rates, and the market's response reflected this heightened sensitivity. The rally of the euro's value, combined with narrowing interest-rate differentials with the U.S. Federal Reserve, suggests that the ECB's rate hikes align with market expectations.

Economist Claus Vistesen, chief European economist at Pantheon Macroeconomics, suggests that the ECB's inflation forecast for 2024 might be overly optimistic. However, Vistesen believes that a significant downward revision before September is unlikely. Consequently, Vistesen anticipates that the ECB will implement two additional 25-basis-point hikes in July and September, ultimately bringing the deposit rate to 4.0%. This rate is expected to serve as the terminal rate for the ECB.

Current Factors Influencing High Inflation

Several external factors have contributed to the persistent rise in inflation within the Eurozone. Disruptions to global supply chains caused by the COVID-19 pandemic have resulted in increased prices, exacerbating inflationary pressures. Furthermore, Russia's invasion of Ukraine has led to record-high energy prices, further fueling inflation. These external events have significantly impacted inflation within the Eurozone and have played a role in shaping the ECB's decision-making process.

Gold as Hedge Against Inflation

Gold investing offers an advantage by serving as a hedge against inflation, as its price tends to rise when the cost of living increases. Inflation denotes the overall rise in the prices of goods and services, resulting in a reduction in the purchasing power of currency.

Chards Mailing List is the ultimate mailing list for bullion dealers that customers need to be on if they are interested in investing in precious metals. Our mailing list is the only one you'll ever need to stay informed about the latest deals, special offers, and product releases. We keep our subscribers updated on everything from investment-grade bullion to rare and collectible coins. By signing up for our emails, customers will never miss out on any fantastic deals or exciting news in the bullion market. Our mailing list is an essential tool for those looking to stay informed and make informed investment decisions.

Interested in signing up today? Sign up to our mailing list and follow us on Instagram, YouTube, Facebook, TikTok and Twitter for coin news.

Related Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2024. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.