Gold Mid-Year Outlook 2023

Synopsis

Discover the Gold Mid-Year Outlook 2023, exploring historical highs, central bank actions, interest rates, and recessionary patterns. With increased volatility and scepticism, gold has shown resilience amidst economic uncertainties. Explore its performance in Q1 and Q2, reducing volatility and offering favourable returns. As Western countries face the risk of recession, gold proves promising, attracting investors seeking stability in turbulent times.

Key Takeaways

- Gold has reached all-time highs during periods of economic uncertainty, making it an attractive investment option.

- Gold experienced a significant increase in value during the first quarter of 2023 but declined in the second quarter.

- The BOE and ECB raised interest rates, while the Federal Reserve (FED) maintained its rate amidst sluggish economic growth in the West.

- The World Gold Council highlights investor skepticism regarding ongoing events and economic performance.

Record Gold All Time Highs

Several central banks in developed markets, such as the Bank of England and the Federal Reserve System, have witnessed significant increases in percentage points. This can be attributed to monetary policy, which entails actions taken to regulate a country's borrowing capacity and the amount of money circulating within its economy. In the UK, we hold the belief that more challenging times lie ahead, as many financial markets anticipate a rise in BOE interest rates to reach 6% by the year's end. Additionally, JP Morgan forecasts that BOE interest rates may peak at 5.75%, but depending on various scenarios, they could potentially surge to 7%. Naturally, such an outcome would prove disastrous for a considerable portion of the UK population. According to the World Gold Council, investors are skeptical of the ongoing events.

Given the historical lag between monetary policy and economic performance, investors are wary that a hard landing may be still to come (source)

The base rate has undergone a significant increase over the last year. To aid the economy during the impact of the coronavirus, the base rate plummeted to its lowest ever point of 0.1% in March 2020 and continued at that level until November 2021. As of Thursday 22nd May 2023, the base rate is 5% after another 0.5 percentage point increase.

Gold Performance 2023 in Q1 and Q2

During the first quarter of 2023, the price of gold in the UK began at £1507.23 per ounce and reached its peak at £1648.20 per ounce on March 20th. This represented a significant increase of 9.36% in the value of gold when measured in GBP However, in the second quarter of 2023, the price of gold experienced a decline, ending at £1518.33 per ounce by the end of June 2023.

Gold not only provided investors with favorable returns but also played a significant role in reducing volatility during the first half of the year, particularly during the banking collapse that occurred in March. The performance of gold in the UK can be attributed to factors such as interest rates, a weakened pound, and ongoing demand from central banks.

Gold vs Other Assets

Figure 1 - YTD Return in GBP of Major Assets

Figures of Assets

| Asset | Start of Year (2023) | 10 July 2023 | Percentage Change |

| FTSE 100 | £7,554.09 | £7,291.95 | -3.47% |

| Bitcoin | £13,723.22 | £23,677.22 | +72.57% |

| BXY | 119.66 | 127.70 | +6.72% |

| Gold | £1,507.23 | £1,521.28 | +0.93% |

| WTI Crude Oil | X | X | -10.50% |

As of 10 July 2023. Data based on the FTSE 100 Index, BTC Price, BXY Index, Chards Live Gold Price, and WTI Crude Oil (CRUD) Index.

Western Tightening Continues

Both the BOE and the European Central Bank (ECB) have increased their interest rates, with the BOE raising rates to 5% and the ECB to 3.5%. Meanwhile, the Federal Reserve (FED) has maintained its interest rate at 5.25%. Considering the sluggish economic growth observed in the Western countries, there is a possibility of adverse consequences on consumer spending. However, we expect the Indian economy to exhibit more resilience, and China may respond to potential economic stimulus later in the year, thereby offering some support to local demand.

Furthermore, although numerous Western countries have successfully reduced inflation, there are still other factors at play, such as stock market volatility, geopolitical issues, and the potential for future financial crises. As a result, hedge strategies, including investments in gold and other commodities, are likely to remain viable options during periods of economic uncertainty.

Recession Risks

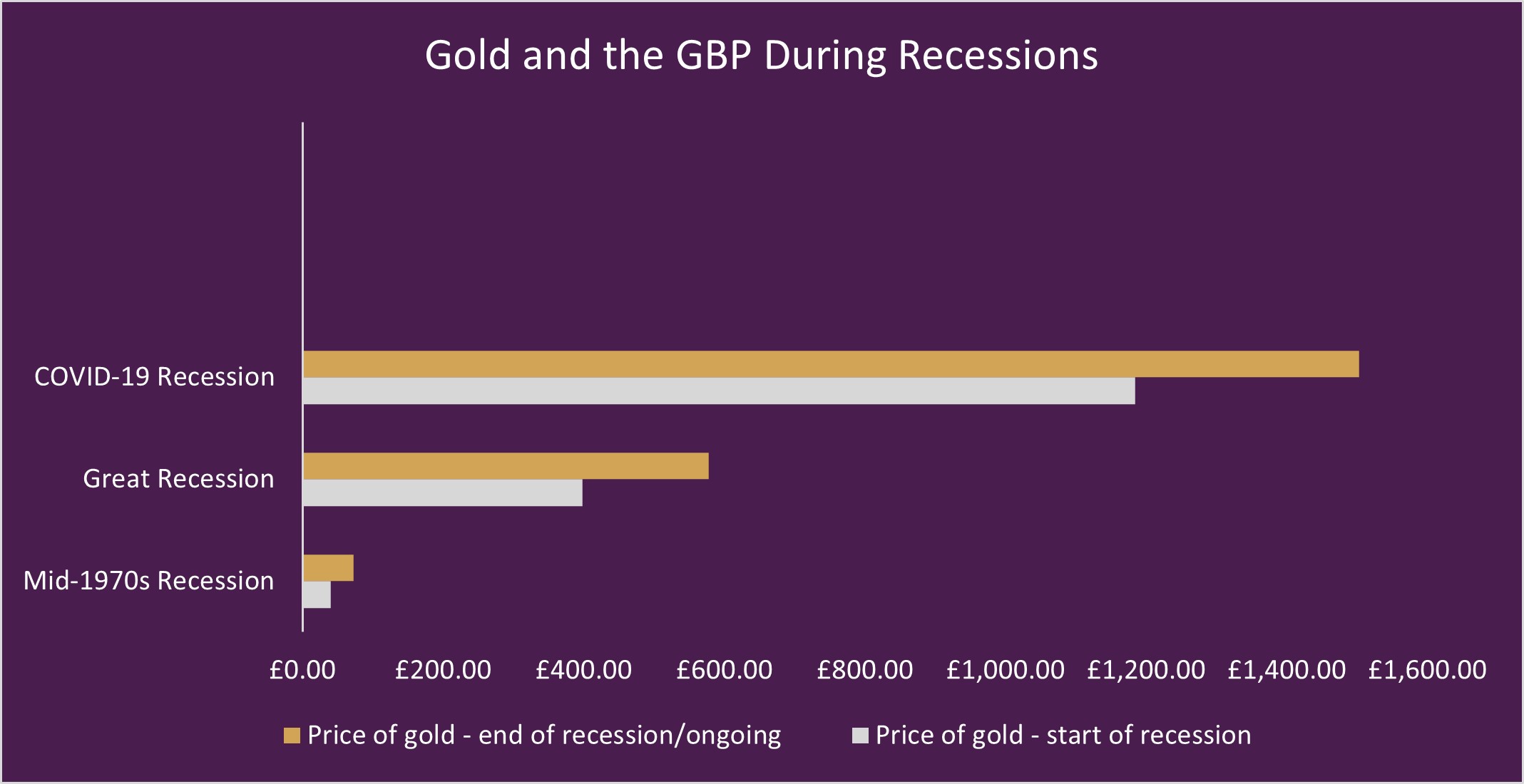

In the current landscape, as the West grapples with the looming threat of recession, the prospects for gold investors appear promising. Throughout history, periods of economic uncertainty have unleashed high volatility, substantial downturns in the stock market, and an ever-growing inclination towards assets that boast both quality and ease of trade like gold. (Figure 2)

Gold Performance During UK Recessionary Periods

Figure 2 - Gold and the GBP during recessions

Mid-1970s Recession: In 1973, the price of gold stood at £39.67 and increased to £72.52 by the end of 1975.

Great Recession (December 2007 to June 2009): During this period, the price of gold began at £397.87 and rose to £577.56 per ounce by the end.

COVID-19 Recession - Current (20 February 2020 onwards): The price of gold started at £1,184.29 per ounce. As of the present day, at the time of writing, the price stands at £1,502.95 per ounce. It is worth noting that in Q1 of 2023, the price of gold saw a significant acceleration, reaching £1,648.20 per ounce on March 20th.

Gold Price Predictions 2024

As the financial landscape evolves and market conditions shift, the gold price outlook for 2024 is generating considerable interest. While future price movements are subject to a range of variables and uncertainties, experts are carefully analysing global economic indicators to form predictions. It is anticipated that factors such as inflation, geopolitical dynamics, and market volatility will have a significant impact on gold's value, making it an appealing asset for investors seeking stability and potential returns in the upcoming year.

Predictions from Experts

- ABN Amro - $2,000

- AG Thorson for FX Empire – Target of $3,000

- Natixis - $1,920 average

- UBS - $2,250

- BMI - $1,850

- Trading Economics - $2,016

- Commerzbank - $2,050

Current Geopolitics Issues

One of the most significant factors influencing the current gold price is the ongoing invasion of Ukraine by Russia, which commenced in 2022 and could potentially extend into 2024. Recent developments in the war have brought attention to a brief mutiny by Russian private military company Wagner, Ukraine's exclusion from NATO membership until the war concludes, and the uncertainty surrounding the possibility of NATO members being drawn into more severe conflicts.

On July 7, 2023, the Russian government reported through state-controlled RT News that the BRICS nations, comprising Brazil, Russia, India, China, and South Africa, have confirmed the introduction of a new tradable currency backed by gold. BRICS refers to a group of emerging economies that have experienced considerable growth and aim to challenge Western dominance in global affairs.

Furthermore, China's recent decision to impose restrictions on the export of essential materials crucial to chip production has raised further alarms. Additionally, the ongoing dispute between China and Taiwan remains a potential threat, although the United States has recently tempered its stance on safeguarding Taiwan's independence.

Related Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2025. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.