Bank of England Interest Rates Remains at 5.25%

Synopsis

In September 2023, the Bank of England opted not to raise interest rates and chose to keep them at 5.25%. The UK's inflation rate for August 2023 decreased to 6.7%, although it still surpassed the 2% target. A year earlier, a controversial mini-budget by former Chancellor Kwarteng led to a record-low pound and economic turmoil, eventually prompting Prime Minister Truss's resignation.

Bank of England Raises Interest Rates Remain at 5.25%

On September 21, 2023, the base rate was left unchanged, remaining at 5.25%. This marked the first occasion in the last fifteen monetary policy meetings that interest rates did not increase, dating back to December 2021.

Figure 1 - Bank of England Base Rate 2008-2023

Changes in the Bank of England Base Rate Since December 2021

| BOE Meeting Date | Bank of England Funds Rate | Rate Change (bps) |

| Dec-21 | 0.10 to 0.25% | + 0.15 |

| Feb-22 | 0.25% to 0.50% | + 0.25 |

| Mar-22 | 0.50% to 0.75% | + 0.25 |

| May-22 | 0.75% to 1% | + 0.25 |

| Jun-22 | 1% to 1.25% | + 0.25 |

| Aug-22 | 1.25% to 1.75% | + 0.50 |

| Sep-22 | 1.75% to 2.25% | + 0.50 |

| Dec-22 | 2.25% to 3.50% | + 1.25 |

| Feb-23 | 3.50% to 4% | + 0.50 |

| Mar-23 | 4% to 4.25% | + 0.25 |

| May-23 | 4.25% to 4.50% | + 0.25 |

| Jun-23 | 4.50 to 5% | + 0.50 |

| Aug-23 | 5% to 5.25% | + 0.25 |

| Sep-23 | 5.25% to 5.25% | - |

Figure 2 - England Base Rate Since December 2021

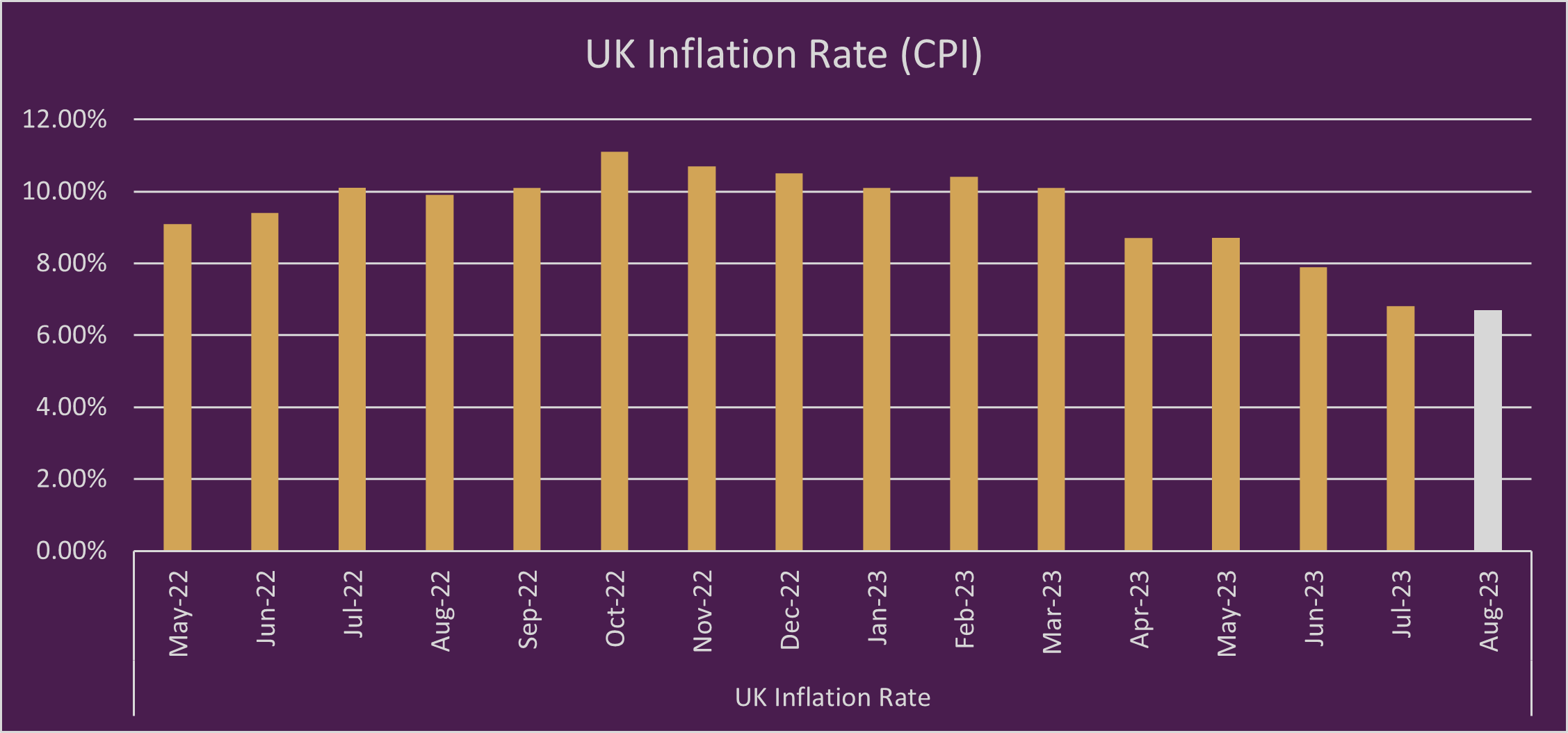

UK Inflation Rate - August 2023

On September 20, the Office for National Statistics released the Consumer Price Inflation data for the United Kingdom for August 2023. The annual inflation rate, as measured by the Consumer Prices Index (CPI), decreased by 0.1% from 6.8% in July to 6.7% in August. This was particularly surprising, as many economists had forecasted that the August CPI would rise above 7%. While it's positive that the CPI has decreased, this figure is still significantly higher than the 2% target set by the Bank of England for the inflation rate.

Similarly, the CPIH (Consumer Prices Index including owner occupiers' housing costs) also experienced a decrease of 0.1%, moving from 6.4% to 6.3%. July 2023 witnessed a significant decline in this figure, as the CPIH dropped from 7.3% to 6.4%. This decrease can be attributed to the Bank of England's decision in their June 2023 meeting to raise interest rates by 0.5 percentage points, from 4.5% to 5%.

Figure 3 - UK inflation rate since May 2022

As illustrated in the graph above, the UK inflation rate has decreased dramatically since October 2022, when it reached a 41-year high of 11.1%. In November 2022, this prompted one of the largest interest rate hikes by the Bank of England, from 2.25% to 3%, in an effort to combat soaring inflation in the UK. Since then, there have been seven additional rate increases as the Bank of England continues its efforts to reduce inflation to the 2% target.

One Year Since the Mini Budget Disaster

On September 23, 2022, Akwasi Addo Alfred Kwarteng, who previously served as the Chancellor of the Exchequer under former Prime Minister Liz Truss, announced the 2022 UK mini-budget. On October 14, 2022, Chancellor Kwarteng was dismissed from his position by the then Prime Minister, Liz Truss, just 38 days into his tenure. His dismissal occurred shortly after he unveiled a mini-budget that included the largest tax cut in 50 years, sparking questions from the financial markets.

Truss would subsequently designate Jeremy Hunt as the new Chancellor. Under Hunt's leadership, many of the questionable tax cuts introduced by Kwarteng would be reversed, resulting in a significantly more favourable market response.

Just 11 days later, on October 25, 2022, Liz Truss resigned amid pressure from both the UK public and the government. Her resignation was largely attributed to the failure of the mini-budget that had destabilised financial markets. Her tenure lasted only 49 days, making her the shortest-serving UK Prime Minister in history.

What Was the Mini Budget?

Liz Truss's mini-budget incurred a staggering cost of £30 billion for the country and encompassed a wide array of tax reductions and economic policies.

- Basic income tax rate from 20% to 19%

- Elimination of the highest (45%) income tax rate in England, Wales, and Northern Ireland (halted after 10 days)

- Reversal of a previously announced plan made in March 2021 to raise corporation tax from 19% to 25% starting in April 2023 (lasted 21 days)

- Undoing of the National Insurance hike implemented in April 2022

- Abandonment of the proposed Health and Social Care Levy

The Impact of the Mini Budget

- The Great British Pound fell to a record low against the dollar ($1.033) on 26 September 2022

- Mortgage rates began rising

- In October 2022 UK Inflation reached a 41-year high of 11.1%

- In November 2022, this prompted one of the largest interest rate hikes by the Bank of England, from 2.25% to 3%

Related Articles

This guide and its content is copyright of Chard (1964) Ltd - © Chard (1964) Ltd 2025. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited.

We are not financial advisers and we would always recommend that you consult with one prior to making any investment decision.

You can read more about copyright or our advice disclaimer on these links.